- ETH supply decreases by 0.23% after the Ethereum Merge update.

- As per CoinMarketCap, Ethereum is on a bull run with a 1.95% increase in price.

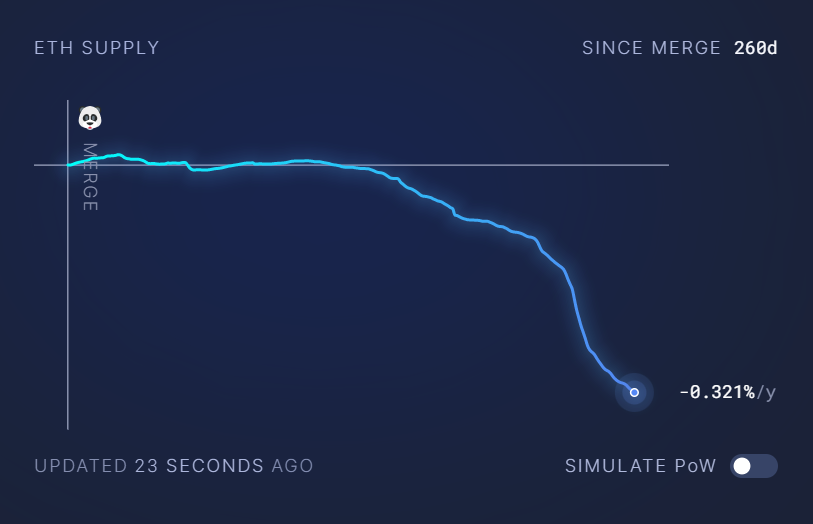

As per today’s record, the ETH supply is shrunken with a decrease of 0.23% from the total market supply. This is due to the Ethereum Merge which is a recent network update. However, the update transits Ethereum (ETH) from Proof-of-work (PoW) to Proof-of-stake (PoS) consensus mechanism.

With this, the ETH transaction fees likely get burnt on a fraction. This is termed to be Ethereum is deflationary which means the supply decreases over time on that particular currency. Furthermore, Ethereum is bullish over the last 24 hours.

ETH on a Bull Run

As per CoinMarketCap, Ethereum is facing an increase of 1.95% with a trading volume of more than $5,970,936,776 in the crypto market. Though the memecoins like PEPE are expanding, major cryptocurrencies like ETH still rule the trade market.

Moreover, the price of ETH is $1,909.14 with all of its supply in circulation. This marks an overall increase of 4.11% over the week and the bull run continues. When compared with Bitcoin (BTC), there is a difference in the graph pointing upward and downward for Ethereum and BTC respectively.

Decrease in Ethereum Supply

Whereas, the ETH supply is on the edge of a decrease of around 0.321% per year after the Merge update was released. There could be a possibility of Ethereum reaching $2K sooner or later as bullish momentum prevails. Additionally, the current supply of ETH accounts for nearly 120M tokens.

Meanwhile, the results of the burn count 738,803.24 at the time of analysis and a decrease of 276,181 ETH over the supply change. This has reduced the supply growth by 0.32% over the year since the Merge.

Recommended For You: