Glassnode data shows Ethereum’s total transaction fees recorded their highest-ever earnings in September 2020, stood at an all-time high of $166 million for the month which is more than the $26 million taken in Bitcoin fees.

The major factor behind this rise is the growth of the decentralized finance (DeFi) market in the crypto space. Moreover, miners are individuals or entities who use computing rigs to maintain and mine blocks on proof-of-work cryptocurrencies for rewards.

Some miners explained that much of the growth came as increased trading activity in low-cap DeFi projects and non-fungible tokens. For instance, the Ethereum price is at $352.45 with a 24-hour trading volume of over $14.1 billion, according to Coingecko.

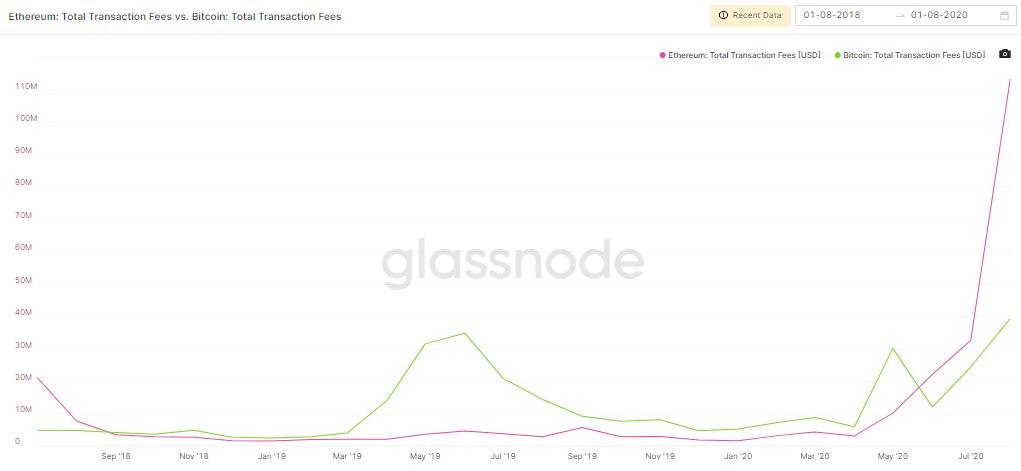

As per data, in March and April Ethereum miners made an average of $4 million in fees. However, Miners pocketed $22 million and $32 million in June and July respectively as the DeFi industry started to gain steam due to the launch of lending protocol Compound.

At the start of 2020, the monthly Ethereum fees were just $1.5 million. This is similar to total value locked (TVL) in DeFi, which first broke the $1 billion in February but surged over $11 billion in summer, according to DeFi Pulse.

Recommended for You