- The global crypto market cap decreased by 6.41%, falling from $3.59T to $3.36T, reflecting widespread losses.

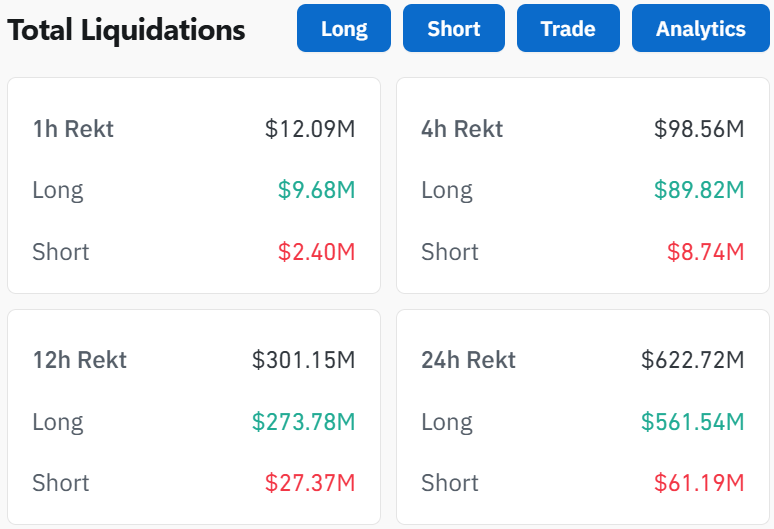

- Over $622 million worth of crypto positions were liquidated in the past 24 hours.

According to the Asian trading hours, the cryptocurrency market witnessed a sharp correction overnight as major cryptos like Bitcoin (BTC), Ethereum (ETH), and popular altcoins faced significant losses. This pullback comes due to a broader sell-off in U.S. tech stocks, including Nvidia and Tesla, and rising macroeconomic pressures.

Bitcoin Drops Below $100K

Over the past 24 hours, Bitcoin saw a 5.79% drop, falling to $96,120 and slipping below the physical $100,000 support level. Ethereum dropped nearly 9% to $3,343—retraced from its prolonged $3.5K target. Further, Ripple’s XRP slid 7.72% to $2.27, while meme coins were also hit hard, with Dogecoin losing over 12.77% to trade at $0.3464.

As a result of this, the global crypto market cap shrank by 6.41%, falling from $3.59 trillion to $3.36 trillion. Liquidations hit $622.26 million in the past 24 hours, with nearly 202,099 traders withdrawn. The largest single liquidation was incurred on Binance, with an ETH/USDT order worth $17.74 million.

Why the Crypto Market Crashed Today?

The market’s sharp correction comes amid rising concerns over U.S. economic conditions, which rattled both traditional and digital asset markets.

- Rising U.S. Treasury Yields: The 10-year yield climbed to 4.7%, signaling tighter monetary policies that discouraged investment in riskier assets like cryptocurrencies.

- Tech Stock Weakness: This increase in bond yields and expectations of further Fed actions to curb inflation put pressure on tech stocks like Nvidia and Tesla, triggering a domino effect that affected the crypto market as well.

- Labor Market Data: Meanwhile, rising job vacancies have kept inflationary concerns high, increasing the likelihood of a more hawkish Federal Reserve stance.

Rising bond yields and concerns about inflation continued to weigh heavily on both traditional and digital asset markets, including cryptocurrencies. This combination of factors led to market pessimism, with investors pulling back from risk assets.

What’s Next? Buy, Sell, or Hold?

While some may see this as a time to sell, long-term investors could view the dip as an opportunity. Historically, Bitcoin and other major assets have rebounded after sharp corrections. Even after the 2021 bull market, BTC dropped nearly 80%, but now it has crossed above the $100K zone.

For risk-averse investors, holding remains a practical option to avoid selling at a loss during market volatility to avoid the risk of selling low and missing potential recoveries. However, as bond yields rise and macroeconomic risks persist, stronger U.S. dollar dynamics could pressure crypto further.

Despite the current downturn, analysts believe the bull market remains intact for Bitcoin. While leading altcoins have halted their recent gains, institutional interest and growing adoption could help the market recover once macroeconomic pressures ease.

Highlighted Crypto News Today

Galaxy Digital Offloads $12.4M ENA Amid 14% Price Drop

Disclaimer: The opinion expressed in this article is solely the author’s. It does not represent any investment advice. TheNewsCrypto team encourages all to do their own research before investing.