- The “BRIDGE Digital Assets Act” proposes a joint committee by the CFTC-SEC to unify digital asset regulations.

- The advisory committee will guide decentralization, functionality, and security to enhance market efficiency.

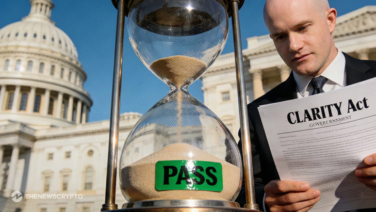

Congressman John Rose from Tennessee has introduced a bill aimed at streamlining digital asset oversight through a unified regulatory approach. The proposed legislation, known as the “BRIDGE Digital Assets Act” (also referred to as the “Bridging Regulation and Innovation for Digital Global and Electronic Digital Assets Act”), seeks to establish a Joint Advisory Committee managed collaboratively by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

The main purpose of this commission mentioned in the bill is to provide the commissions with advice on the rules, regulations, and policies of the commissions related to digital assets. Also, the primary objective of this act is to offer comprehensive advice. To both commissions on developing and implementing rules, regulations, and policies concerning digital assets.

The advisory committee will play a crucial role in shaping these regulations. Providing expert guidance on key aspects such as decentralization, functionality, information asymmetries, and network security. Comprising at least 20 non-governmental members, the committee will be equally appointed by both the CFTC and SEC. Its diverse membership will include digital asset issuers, registered participants, academic researchers, and users, ensuring comprehensive insights and balanced perspectives.

Digital Asset Regulation and Evaluation

This initiative is designed to enhance financial market efficiency and protect participants. By addressing the complexities of digital assets, blockchain systems, and distributed ledger technology. The committee will focus on harmonizing digital asset policies between the CFTC and SEC, addressing key aspects such as decentralization, functionality, information asymmetries, and security.

By enhancing regulatory cohesion, the BRIDGE Digital Assets Act aims to improve the efficiency of financial market infrastructure and safeguard market participants. Additionally, it will explore the potential of digital assets, blockchain systems, and distributed ledger technology to foster innovation and ensure robust financial protection.

Highlighted Crypto News Today:

Donald Trump Set to Launch World Liberty Financial