Blockchain exchange-traded funds (ETFs) invest in companies that use blockchain technology or profit from it in some way. Blockchain is composed of complex blocks of digital information and is increasingly being used in banking, investing cryptocurrency, and other industries.

The financial sector reports that blockchain ETFs are positively gaining traction as the firm notices increased interest in exchange-traded funds. Blockchain ETFs may benefit from the increased development and usage of blockchain technology.

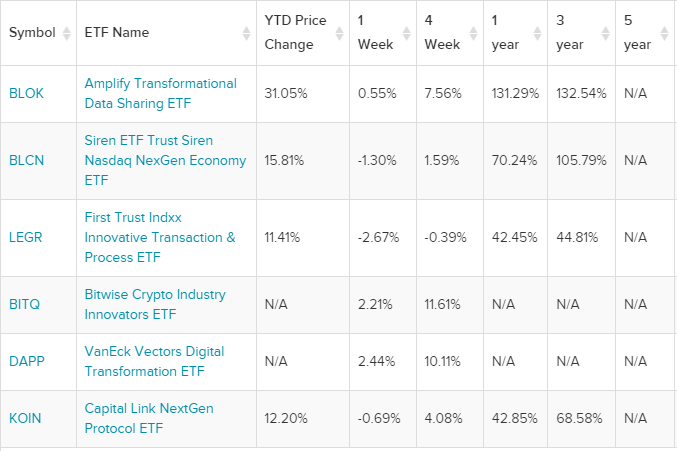

According to the database provided by ETFdb.com, US blockchain ETFs report an average ROI of 74% over last year.

Among the top blockchain ETF’s, Amplify Transformational Data Sharing ETF has the highest return of investment at 131.29%. Following that SIren ETF Trust Siren Nasdaq NexGen Economy ETF at 70.24%.

Moreover, Capital Link NextGen Protocol ETF has returns of 42.85% and First Trust Indxx innovation Transaction & process ETF at 42.45%.

Additionally, these are the funds that are involved in the transformation of business applications via the development of blockchain technology. Based on the performance of Bitcoin, ETH, and other cryptocurrencies, the funds are invested. Besides, they also invest in crypto products offered by asset managers such as Grayscale and Bitwise.

Regulatory Hurdles From SEC

Many investors in the US are eagerly waiting to run Bitcoin ETFs, the returns give them an idea of what to expect in bitcoin ETFs if the US accepts it. However, they continue to face regulatory obstacles from the Securities and Exchange Commission.

One SEC argument is that bitcoin is traded on largely unregulated exchanges, exposing it to fraud and price manipulation risks. Furthermore, the US regulator postponed its decision on CBOE Global Markets’ latest filing.

Recommended for you