- Uniswap (UNI) price climbed by 16.89% over the past 24 hours and reached an intraday high of $13.77.

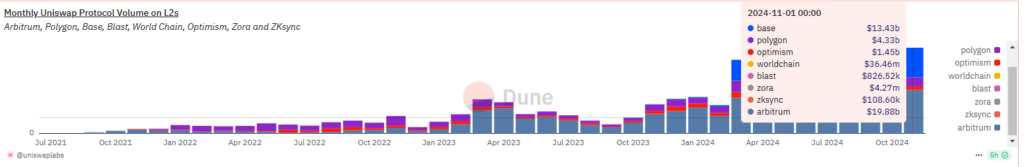

- Uniswap hit a record $38 billion in monthly volume across Ethereum Layer-2 networks in November.

The global cryptocurrency market has displayed a notable surge today, led by Bitcoin’s impressive rally, which has seen its price climb back to $95K from the $90K dip. This bullish movement comes on the heels of several positive announcements, including the Bitwise 10 Crypto Index Fund’s application with the SEC. As the flagship cryptocurrency regained momentum, it sparked a broader market recovery, with altcoins like Uniswap (UNI) leading the charge by jumping to an 8-month high.

Over the past 24 hours, Uniswap saw a 16.89% increase in its price, climbing from a low of $11.78 to an intraday high of $13.77. The surge in UNI’s price was followed by a significant 115% rise in its trading volume—reaching $1.22 billion. In parallel, Uniswap’s open interest surged by over 22%, hitting $245 million, a level not seen since February.

But the good news doesn’t stop there. Uniswap has shattered its monthly volume record on Ethereum’s layer-2 networks.

According to Dune Analytics, the decentralized exchange processed an impressive $38 billion across major platforms such as Base, Arbitrum, Polygon, and Optimism throughout November. This surge in activity has propelled Uniswap to become the sixth-largest protocol by fees, generating over $90 million in the past month alone.

The uptick in trading and volume has had a significant effect on UNI’s price. It has surged by over 46% in the past week alone. Currently trading at $12.95, UNI has witnessed a 64% rise over the past month. This price movement has pushed its market cap to $7.76 billion.

Bullish Chart Pattern Signals Continued Uptrend

The daily chart for UNI reveals a clear breakout from a prolonged correction. The cryptocurrency is now trading within an ascending channel, signaling a continuation of the bullish trend.

Zooming in, the RSI for Uniswap is at 63 in the UNI/USDT 4-hour trading pair. That suggests the asset is in the neutral to bullish zone, with no immediate overbought or oversold conditions. Further, the CMF for UNI is at 0.15. That indicates a moderate accumulation of buying pressure, with the market showing a positive flow of money.

With positive momentum building, UNI could see more upside before encountering significant support around the $10 zone.

Highlighted News Of The Day