In the past, the crypto market has faced failures in the algorithmic stablecoins, the mechanism behind the stablecoins seems to be prominent in papers. Still, when it comes to executing them in the real-world, the hurdles are more challenging. Some examples to be remembered are Titan and Iron.

The fundamental difference between a fiat pegged stablecoin and an algorithmic stablecoin is that fiat stablecoins have 1 to 1 pegging to traditional currencies like USD or Euro, the algorithmic stablecoins use an algorithm, mint more coins when the price goes up, and burn them when the price comes down.

Terra ecosystem was founded in 2018 by the TerraForm Lab (TFL) and the development of the ecosystem is administered by Luna Foundation Guard (LFG). Terra is built over the Cosmo SDK, which guarantees the operation across various platforms.

Do Kwon, Co-Founder, and CEO of TFL has always been an effective spokesperson for his company.

“For the first time, you’re starting to see a pegged currency that is attempting to observe the bitcoin standard. It’s making a strong directional bet that keeping a lot of those foreign reserves in the form of a digital native currency is going to be a winning recipe.”

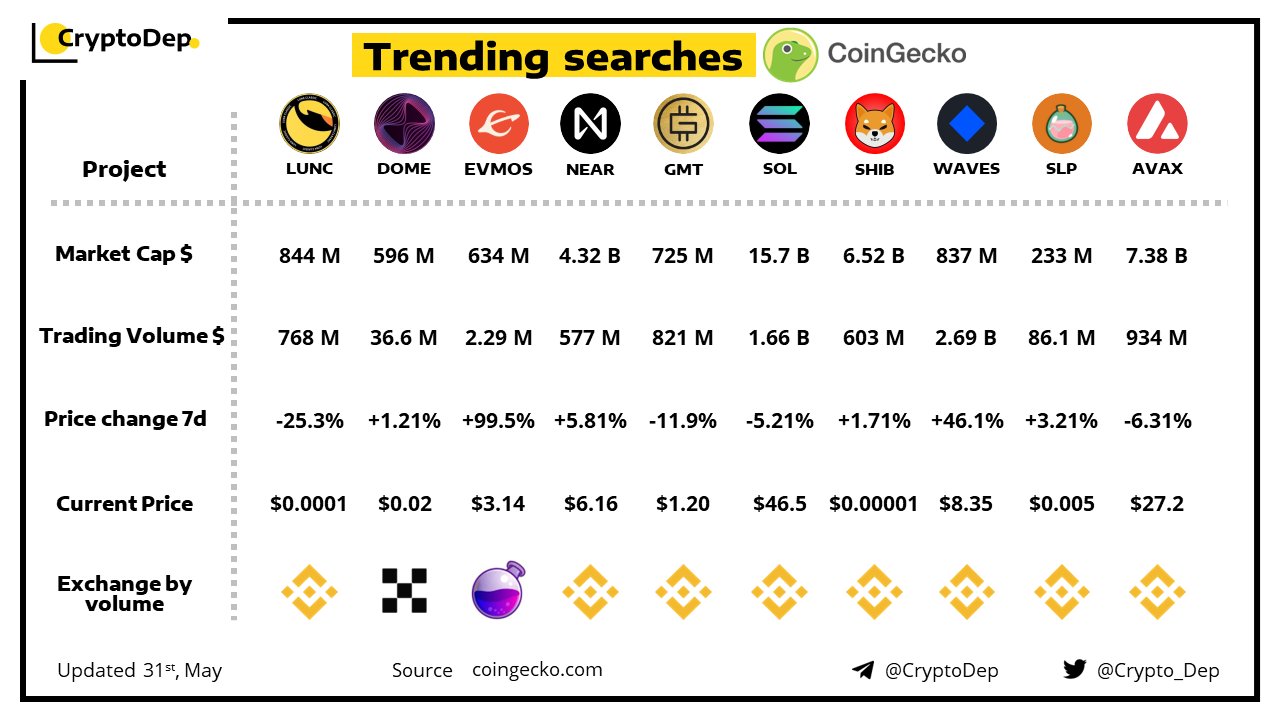

And the USD was also sailing high in the market. The plans behind Terra were also courageous, 10 billion BTC reserve, purchase of AVAX, commitment towards the Anchor & Mirror protocol, and so on.

LFG tweet:

1/ As of Saturday, May 7, 2022, the Luna Foundation Guard held a reserve consisting of the following assets:

— LFG | Luna Foundation Guard (@LFG_org) May 16, 2022

· 80,394 $BTC

· 39,914 $BNB

· 26,281,671 $USDT

· 23,555,590 $USDC

· 1,973,554 $AVAX

· 697,344 $UST

· 1,691,261 $LUNA

But all these were hit badly when the Terra team made a huge withdrawal from the curve finance that happened to follow the swapping of UST for USDC by an unknown whale in the same exchange platform, this created variation in the UST depeg. The crashing of the crypto market was further fueled by this action.

Post Bear Market

Panic selling started as the price of Luna declined on May 9, major crypto apps pulled out their user assets from Anchor as UST depegged, and within the first 48 hrs, 9 billion was drawn out from 14 billion held by Anchor. This made the circulation of Luna enlarged with price downfall and UST trembled as it is the representation of Luna.

The minting of Luna was prominent then burning and suspicious activity during validation began. Attackers started using this loophole and malicious transactions were validated, this raised another concern in the collapsing sector and the Terra halted their delegation altogether. Simultaneously, LFG employed the BTC available with it to regain the peg.

Terra tweet:

The Terra blockchain has officially halted at block 7607789.

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) May 13, 2022

Terra Validators have halted the network to come up with a plan to reconstitute it.

More updates to come.

The blame game is still prevailing but no proper conclusion has yet been obtained, most fingers are been pointed out towards the lack of backup strategy by Do Kwon and no proper communication among the “Lunatics” and Terra. Another major suspect in consideration is the traditional finance system and its representatives.

Currently, the revival plan taken on by Terra is the launch of a new blockchain but that completely excludes the stablecoin. The new Terra is expected to hit the market on May 27 and is at present in the voting phase.

Terra tweet:

1/ We have published an amendment to Proposal 1623, incorporating the community’s feedback since its publication 2 days ago. Please see below for details 👇https://t.co/liISBn3Baa

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) May 20, 2022

The snapshot will be taken on May 27, and the user with the current Luna & UST will be assigned a new Luna. The center of attraction in the launch is the airdrop by the Terra, the segregation is as follows 25% to community pool, 35% to Luna holders before the collapse, 10% to UST Anchor holders before the collapse, 10% to Luna holders after the collapse and 20% UST holders after collapse.

This seems to be the only getaway from the death spiral. As most investors are just looking for a way to get back their money, certain projects inside the company are waiting for liquidity to proceed further. This announcement has itself made rise in the price of coins and expected to bring back the status.

Recommended for you