- Solana (SOL) has made quite an impact, with a price increase of 140% in the last 30 days.

- At the time of writing, SOL is trading at $53.55, down 7.95% in the last 24 hours.

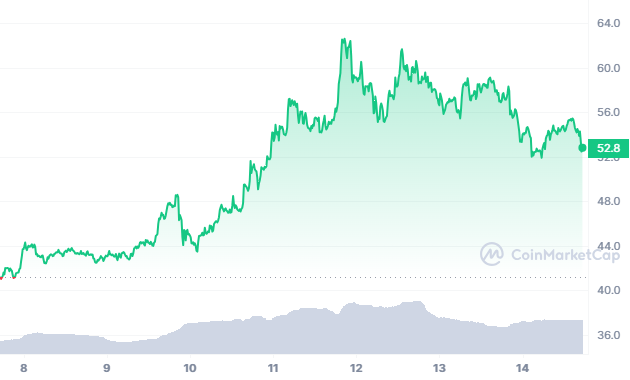

Solana’s surge has been exceedingly spectacular, with the price rising to unprecedented levels. Despite the recent brief correction, Solana (SOL) has made quite an impact, with a price increase of 140% in the last 30 days.

While wallets linked to the defunct FTX exchange continue to trade millions of dollars worth of SOL, the token’s climb seems to have stalled. PeckShield reports that addresses associated with FTX have sent large quantities of SOL ($13.5M) and USDT stablecoins to trading platforms including Binance and Wintermute.

The transfer today occurs one week after the organization sent more than $30 million worth of SOL to Binance and another cryptocurrency exchange, Kraken. As of the 14th of November, FTX and Alameda have moved 42 assets worth a total of $438M into exchanges.

Brief Correction

As with previous large transactions, the SOL price has been impacted by the transfer of funds from wallets associated with the defunct FTX to exchanges. Moreover, the RSI indicator approaches the overbought region, which generally signals a drop as traders might probably take gains.

At the time of writing, SOL is trading at $53.55, down 7.95% in the last 24 hours as per data from CoinMarketCap. However, the trading volume is up 23.61%. The price is facing severe selling pressure after reaching a high of $62.5.

If the price manages to go past $56.9 resistance level, then it will likely climb further to retest $62.5 level. However, if the price goes below $51.9 level, then price will likely test $49.0 support level.