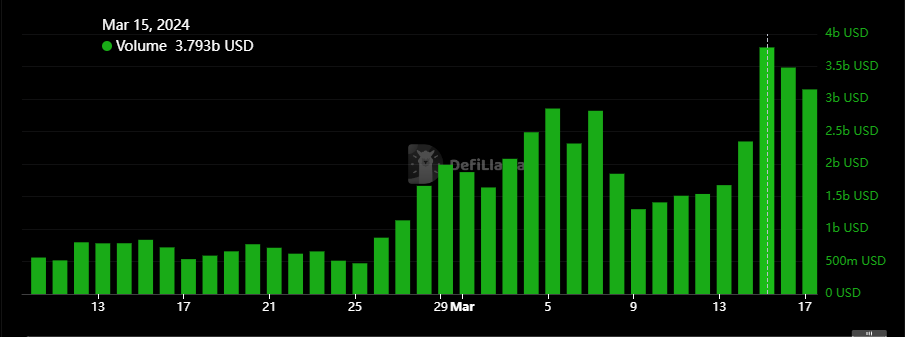

- Solana recorded its highest-ever trading volume of $3.793 billion.

- Solana’s DeFi total value locked surged by 122% in a month, hitting $4.72 billion.

While giants like Bitcoin and Ethereum are grappling with slight downward trends, Solana has emerged as a top contender for bullish momentum. Over the weekend, the Solana network witnessed a surge in activity, outpacing Ethereum, driven by a frenzied fan rush towards Solana-based memecoins.

On March 15th, trading volume on Solana climbed to a record-breaking $3.793 billion, marking the highest level in its history. For two consecutive days after that, Solana’s daily trading volume surpassed Ethereum’s around $1.4 billion, according to DefiLlama.

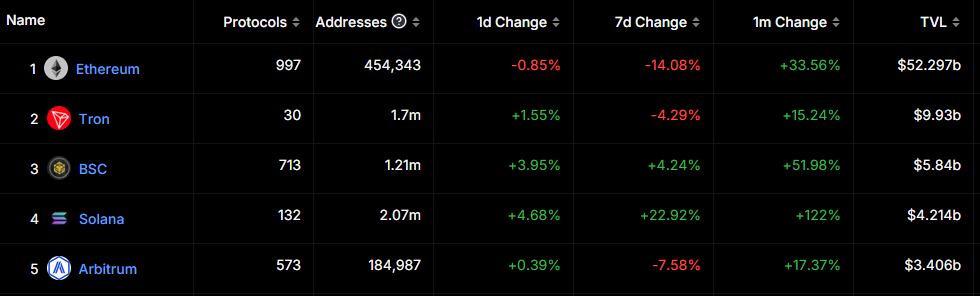

Solana TVL Soars 120%

DeFi total value locked (TVL) on Solana has experienced a significant surge of over 122% in the past month alone. This surge has propelled Solana’s DeFi TVL to its highest level in two years, reaching $4.214 billion at the latest tally. Among the top five DeFi networks by TVL, Solana has displayed the most remarkable growth over the past month.

This remarkable growth in Solana’s TVL can be attributed to the substantial increase in trading volume on DeFi protocols hosted on the Layer 1 network (L1). As a result of these developments, Solana’s native cryptocurrency, SOL, has showcased a staggering 800% surge in price over the past year, breaching the crucial resistance level of $200.

At the time of writing, SOL was trading at $203, with a market cap of $90 billion. This surge in value has propelled SOL to claim the fourth position in the market, surpassing Binance Coin (BNB).