- Spot Ethereum ETFs were approved by the SEC on May 23.

- Three Exchanges had proposed rule changes to list and trade spot ETH ETFs.

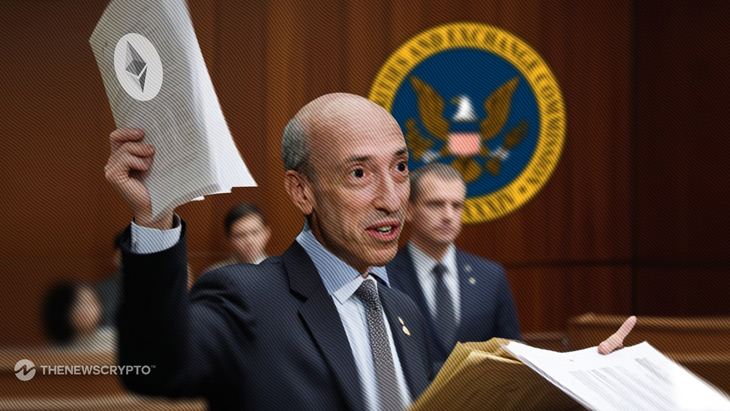

The Securities and Exchange Commission (SEC) released an official statement approving the spot Ethereum Exchange-Traded Funds (ETFs) on May 23. The SEC’s statement was widely anticipated by the crypto community since the approval of spot Bitcoin ETFs. Exchanges that had applied for issuance rights were approved in the published report, while they still await the approval of S-1 filings.

The published report stated:

“As described in more detail in the Proposals’ respective amended filings, each Proposal seeks to list and trade shares of a Trust that would hold spot ether, in whole or in part. This order approves the Proposals on an accelerated basis.”

Spot Ethereum ETFs have drawn immense attention from the community because of the additional debate over ETH’s recognition. The leading altcoin was highly debated if it should be recognized as a commodity or security. The SEC had indicated a recognition of security for Ethereum. Such a designation could reduce investor benefits, stated leading members of the community.

Notably, the SEC had made an announcement last week asking Exchanges to amend their 19b-4 filings. These filings were a requirement for the approval of spot Ethereum ETFs. The SEC’s request stirred an optimistic sentiment in the market.

SEC’s ETF Approval, a Win for Ethereum?

The official report from SEC mentioned three exchange platforms — NYSE Arca, Inc., the Nasdaq Stock Market LLC and Cboe BZX Exchange, Inc. These three exchanges had proposed rule changes to list and trade shares of eight spot Ethereum ETFs which was approved.

NYSE Arca will be listing the Grayscale Ethereum Trust and Bitwise Ethereum ETF. Nasdaq was approved to list and trade iShares Ethereum Trust. BZX will be trading VanEck Ethereum Trust, ARK 21Shares Ethereum ETF, Invesco Galaxy Ethereum ETF, the Fidelity Ethereum Fund and the Franklin Ethereum ETF.

Furthermore, the Commission’s approval has been taken as an indication of it considering Ethereum as a commodity. Leading companies such as Consensys have stated this but officials and representatives of SEC have refrained from comments on the issue.

Additionally, the cumulative spur around spot Ethereum ETF has instigated a bullish rally of the altcoin’s market price this week. The approval has increased the number of spot ETFs available on the market to two including the spot Bitcoin ETFs.

Highlighted Crypto News Today:

Central Bank of Ireland Approves Ramp Network as Virtual Asset Service Provider