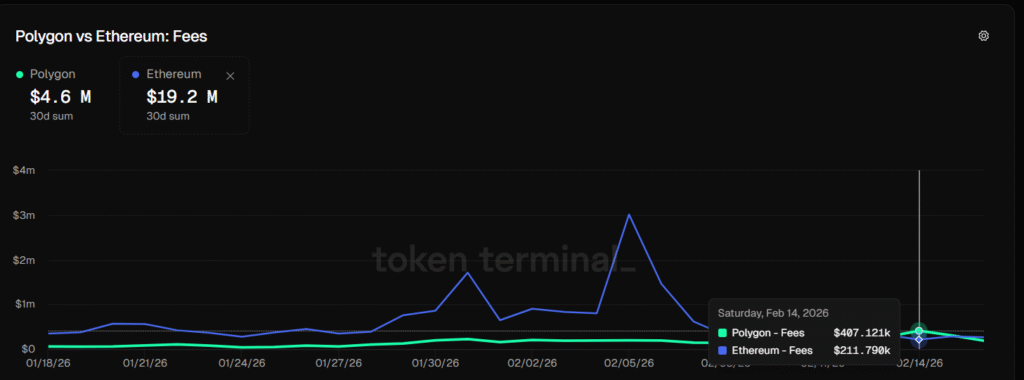

- Polygon earned more in daily transaction fees than Ethereum, reaching over $407k per day.

- The increase in fees was largely driven by activity on Polymarket, a blockchain-based prediction market on the Polygon network.

Polygon, a blockchain network built to scale Ethereum, has recorded higher daily transaction fee revenue than Ethereum for the first time ever, according to data from Token Terminal. The figures show that on Friday, Polygon earned $407.121K in transaction fees, while Ethereum generated $211.790K in the same 24‑hour period, marking a notable shift in network activity.

Over the following day, the trend continued until Sunday with a record of $303.9923K volume. On the latest close, Polygon’s daily transaction fees slightly slipped to $186.508k compared with about $262.710k on Ethereum.

Analysts and blockchain data observers attribute the surge in Polygon’s fee revenue mainly to heavy usage of Polymarket, a prediction market platform operating on the network. According to Matthias Seidl, co-founder of the analytics platform growthepie, recent increases in activity “have been fully driven by Polymarket,” with the platform generating more than $1 million in fees for Polygon over the past seven days.

More fees were paid on Polygon PoS than on Ethereum Mainnet 🤯

— matze | growthepie 🥧 (@web3_data) February 16, 2026

This is fully driven by Polymarket

-> see screenshots of app breakdown by fees paid https://t.co/EU5zDofxiO pic.twitter.com/toqo346VEs

Impact of Polymarket and Stablecoin Activity on Polygon’s Fees

Polymarket’s user engagement appears to have contributed considerably to the shift in on‑chain activity, as users place real‑world event wagers that require frequent transactions. Polymarket is a major prediction market platform in the blockchain space, which began operating in 2020 supported by Polygon. Polygon itself noted that, in one instance related to an Oscars market, more than $15 million in wagers were placed, further driving fee generation.

In addition to prediction market growth, Polygon has seen increased use of stablecoins on its network, particularly USDC, which has reached new weekly highs in transaction counts. This uptick in stablecoin activity suggests broader adoption across decentralized finance use cases.

While Ethereum remains the largest smart contract platform by market value and overall activity, these fee metrics reflect a momentary shift in daily revenue generation. Discussions in the blockchain community now focus on whether such patterns will persist and how they might influence long‑term network competition.

Highlighted Crypto News:

Bundesbank President Urges Development of Euro-Pegged Stablecoins and Retail CBDC