- OKX’s third Proof of Reserves report claims that its reserves are 100% clean.

- OKX plans to open spot trading for the new crypto token $CORE.

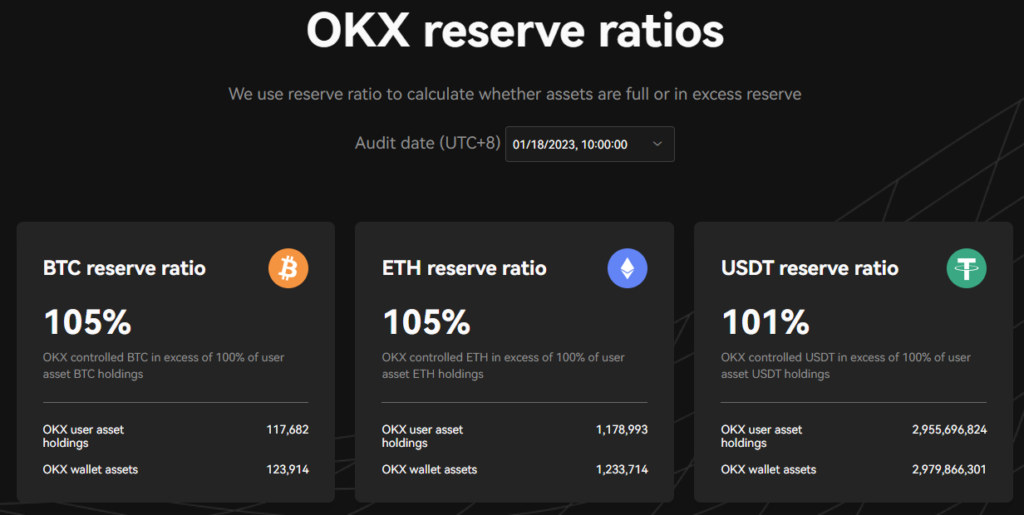

Today the world’s second-largest cryptocurrency exchange OKX ‘OKEx’ has released a “Proof-of-Reserves” (PoR) report that reveals the detailed breakdown of the assets the exchange has in its reserves. OKX’s third monthly PoR report disclosed $7.5 billion in BTC, ETH, and USDT held by the crypto exchange, which does not include its native cryptocurrency ‘OKB.’

According to the analysis, all of the assets in OKX’s reserves overcollateralize the company. The reserve ratio is 105% for Bitcoin ($BTC), 101% for Tether ($USDT), and again 105% for Ethereum ($ETH).

OKX Reserves Entirely Clean

Following the FTX demise, regulatory scrutiny over cryptocurrency exchanges has increased. Centralized crypto exchanges are receiving particular attention for their financial stability. Soon after, the blockchain analytic firm CryptoQuant created a metric to evaluate the cleanliness of cryptocurrency exchanges’ reserves.

OKX exchange’s “commitment to transparency” by publishing such statistics every month. Data from CryptoQuant, confirms that “OKX’s reserves are 100% clean”. But the prominent crypto exchanges are still far from attaining such a high standard of reserve cleanliness. The world’s largest cryptocurrency exchange Binance is 87% clean, Huobi Global is 60%, and Bitfinex is 70% clean in reserve.

Further, OKX’s chief marketing officer Haider Rafique claims that the company has never financed its operations with its native cryptocurrency, as per a media outlet report. However, according to CoinMarketCap, OKX native crypto $OKB price declined by over 5.62% to trade at $30.44. $OKB has a market cap of $1 billion, which decreased to around 5.72%.

Moreover, OKX announced on January 14 that it plans to list the new cryptocurrency token $CORE on its platform to support the CoreDAO ecosystem.