Co-funded by the UK government’s R&D department, Millicent, a distributed ledger fintech business, has completed the world’s first test of a Full-Reserve Digital Currency (FRDC). With Millicent’s FRDC, the central bank receives 100% of the collateral in the form of liquid ‘cash’ deposits held in a ringfenced account under the supervision of a regulated third party. The Digital currencies are created privately and tied to regular fiat currencies.

For Innovate UK, a part of the UK Research and Innovation, the national funding body that has co-funded Millicent’s initiative, the test was planned as a technology demonstration. FRDC tokens tied to the British Pound Sterling were minted and exchanged in a sandboxed environment, as was the on-chain conversion and minting of FRDC tokens, as well as various payment and settlement scenarios.

Key to Millicent’s goal of developing a financial infrastructure that integrates the advantages of distributed ledgers and smart contracts with the existing economic infrastructure is the demonstration’s success. The firm believes blockchain technology has the ability to build a more equitable and accessible financial system for everyone.

According to Innovate UK’s assessors:

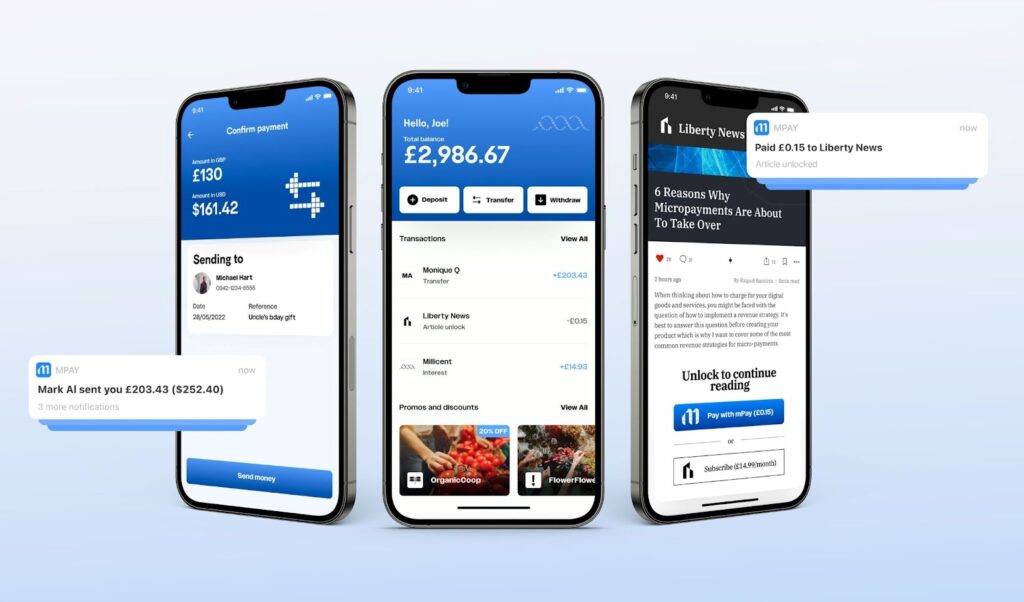

“[Millicent] addresses the major shortcomings of the payments industry, both traditional and crypto. Delivering a digital wallet and payment application accessible via iOS/Android apps, with an API for integration with existing web/mobile platforms within this project is courageous and ambitious.”

When Millicent tested FRDCs for the first time, it found that it could be used to make micropayments, such as paying £0.15 to view a paywalled newspaper article, to tip buskers using a QR code, and even to send larger payments from one person to another. As part of this test, Millicent’s FRDC network was shown to have cheap costs and a near-instant settlement time, as well as a wide range of options for making payments.

It is possible that Millicent’s test could be viewed as the definition of being the first retail test for a synthetic Central Bank Digital Currency (sCBDC), but the company prefers the term Full-Reserve Digital Currency to differentiate its offering from other types of ‘stablecoins’ that have proven to be anything but stable—despite nomenclature convincing the public otherwise.

As a consequence of their potentially dangerous designs and a lack of transparency, stablecoins have recently come under careful examination, which has resulted in delayed mainstream acceptance and severe losses for customers. However, some people remain skeptical about CBDCs because of worries regarding privacy and possible abuse.

To solve these issues, FRDC has been created in anticipation of the United Kingdom’s rapid adoption of regulated digital payments. Disintermediation between the public sector and the end user is provided by a privately produced digital currency, but its assets are backed by 100% entire (not fractional) liquid reserves.

Millicent’s FRDCs are focusing on offering savings and advantages of digital currencies to regular people and small to medium-sized enterprises in a secure and user-friendly way, while other players are developing wholesale CBDCs for settlements between financial institutions.

Stella Dyer, the company’s CEO, said:

“We are extremely proud to have presented this world-first solution to Innovate UK—especially during such a turbulent time for the crypto markets. Recent troubles with popular cryptocurrency platforms highlight the importance of projects like Millicent, that focus on safety, stability, and real-world benefits.”

Since the network is built on a public-permitted infrastructure with democratic community governance, users of Millicent may participate in macroeconomics. It’s a system built from the ground up to be used by the general public for their regular financial transactions.

Stella Dyer, Millicent’s co-founder and CEO, is a big fan of financial inclusion. A child war refugee who came to the United Kingdom, she first studied at Harvard Business School before working at Morgan Stanley, JP Morgan, and then Goldman Sachs as the head of their Global High-Tech Investment Banking Division. She now lives in London with her husband and two children. Ms. Dyer, a committed philanthropist, is trying to establish a global financial system that is open to everyone and provides equal opportunity for all.