- BNB Chain cuts gas fees while recording $51 billion perpetuals volume.

- Validators propose 0.05 Gwei minimum gas price with 450ms block intervals.

- Network achieves over 200 TPS, outperforming major Layer-1 competitors.

BNB Chain has implemented major cost reductions while achieving record trading activity across its network. The blockchain ecosystem continues to attract increased usage through lower transaction fees and enhanced performance metrics.

Network validators have put forward proposals to establish a 0.05 Gwei minimum gas price alongside reduced block intervals of 450 milliseconds. These changes aim to boost network capacity while maintaining low-cost transactions for users.

Former Binance CEO Changpeng Zhao has called for additional fee cuts through social media. “Let’s reduce fees by another 50% on #BNB Chain?” Zhao posted on X, advocating for continued cost reductions.

Technical performance reaches new levels

Community observations reveal that BNB Chain currently processes more than 200 real-time transactions per second. This performance places the network ahead of competing Layer-1 and Layer-2 blockchain solutions in the market.

The enhanced transaction throughput benefits decentralized finance applications, exchanges, and derivatives platforms that require low-cost, high-speed processing. These improvements make the network attractive for traders seeking efficient transaction execution.

One community member noted on X that “at ATH activity, the chain proves its stress-tested scalability.” However, ultra-low fees may create challenges including potential transaction spam or reduced validator revenue streams.

Trading volume reaches record highs

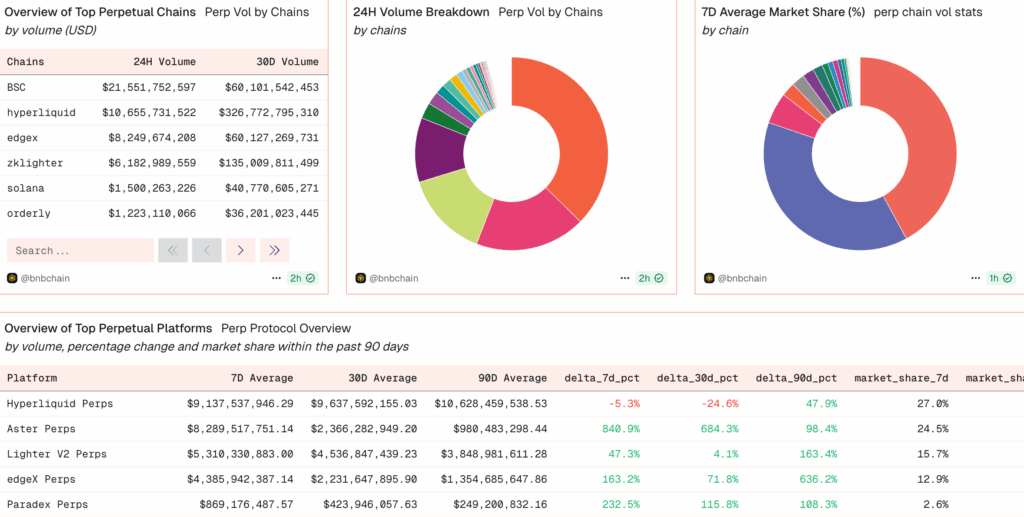

On-chain data from Dune Analytics shows perpetual trading volume hit a peak of $51.3 billion across the ecosystem. BNB Chain contributed approximately $21.5 billion to this total, with Aster perpetual DEX driving much of the recent activity.

The surge in derivatives trading creates genuine demand for BNB tokens as users require the native asset for transaction fees. This trading volume shift toward BNB Chain represents increased adoption of the network for complex financial products.

Santiment data indicates BNB Chain leads development activity over the past 30 days among major blockchains. Short-term stablecoin flows have also moved through Binance infrastructure, positioning BNB Chain as a central hub for stablecoin settlements.

Following the breakthrough above $1,000, BNB price action shows a pullback to retest former resistance levels. The 20-day exponential moving average provides current support, suggesting the upward trend remains active provided this level holds.