- Bitcoin (BTC) fell 17% in a day to $49,089, while Ethereum (ETH) dropped 24% to below $2,125.

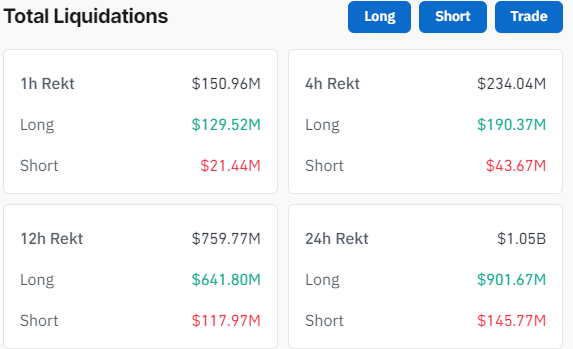

- The global crypto market experienced $1.04 billion in liquidations over the past 24 hours.

In the last 24 hours, the cryptocurrency market faced a sharp downturn, with $901.67 million in long positions liquidated. The sell-off, which surged on Sunday, has stemmed to significant losses across major digital assets like Bitcoin (BTC) and Ethereum (ETH). Also, the decline has pushed the global market cap below $2 trillion, marking its lowest level since February.

Bitcoin dropped sharply, losing over 17% of its value in a single day and 27% over the past week, reaching a low of $49,089. This is the lowest the cryptocurrency has been since February. Ethereum’s decline has been even more pronounced, plummeting by 24% over the past day and 35% on a weekly basis. The price of ETH has fallen below $2,125, erasing its gains for the year.

The sudden market downturn has resulted in several factors. A key trigger is the large-scale liquidation imposed by Ethereum. A significant drop in ETH prices forced several major holders, or ‘whales,’ to sell off their assets to cover their positions. The disappointing economic data and rising geopolitical tensions have worsened this chain reaction of sell-offs.

Other cryptocurrencies have not been spared from the market bloodbath. Altcoins like XRP, BNB, and Solana have also seen substantial declines. XRP has fallen over 19%, trading around $0.4498, while BNB has dropped more than 22%, reaching $413. Solana, another highly hyped cryptocurrency, has dipped below the $115 mark, losing over 21% in value.

Also, the global market has seen substantial losses, with top 100 tokens such as Lido DAO, UniSwap, and Chainlink dropping 19% to 25%, marking the worst single-day decline since February.

Market Pressure from Jump Crypto’s Suspected Ethereum Sales

The pressure on the market came from rumors of large-scale ETH sales by Jump Crypto, a subsidiary of Jump Trading. Reports suggest that Jump Crypto moved substantial amounts of USDC, USDT, and Ethereum between its cold wallets and various exchanges, including Coinbase, Gate.io, and Binance. The move has raised concerns about potential sell-offs, as the firm holds around $243 million in digital assets.

Jump Crypto’s involvement in the market has drawn scrutiny, particularly given its past legal issues related to the collapse of TerraUSD and the Terra ecosystem in May 2022.

Jump Crypto is under investigation by the SEC for its alleged role in manipulating TerraUSD’s price, leading to $1.3 billion in profits for the company and its CEO, Kanav Kariya. This investigation is part of a larger SEC case against Terraform Labs and its founder, Do Kwon, for a multi-billion dollar crypto asset securities scam.