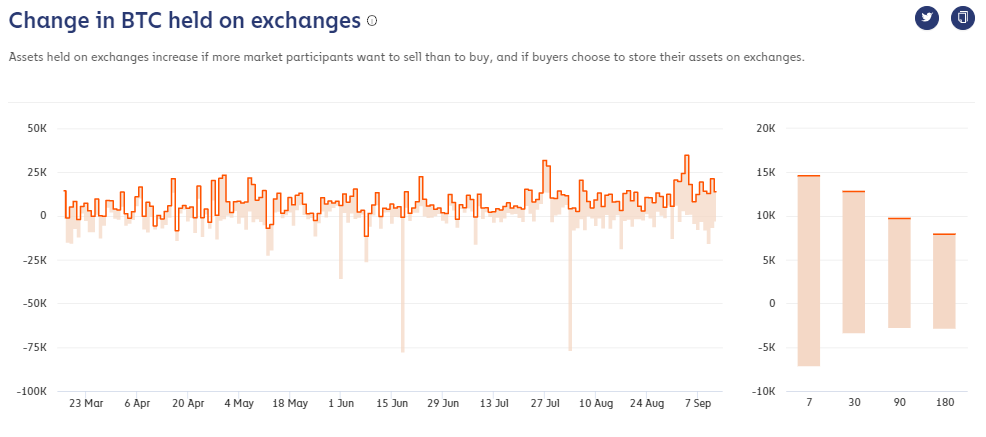

Bitcoins inflows are high on exchanges, with the motive of selling it but the users are not booking orders despite the BTC price drop.

According to Chainalysis data, there was a 26.36 BTC change in Bitcoin held on exchanges which is positive and above the 180-day average. This indicates that there is an increase in Bitcoin held on exchanges. Bitcoin inflows exceed above 110% in crypto exchanges.

Change in Bitcoin on exchanges (Source: Chainalysis)

Bitcoin the first and top cryptocurrency in terms of market capitalization. At the start of September, Bitcoin experienced a price drop from nearly $12,000 to $10,000. As per CoinGecko, BTC is changing hands at $10,654, at the time of writing.

BTC/USD Price Chart (Source: Trading view)

Meanwhile, the overall cryptocurrency market cap now stands at $350.9 billion. Bitcoin’s dominance index presently at 56.4%. When the BTC price goes up, there will be more inflows than outflows on the crypto exchanges. Users are waiting for a price rise to a particular level to execute their sell orders and get on profits.

Moreover, Bitcoin interests are increasing worldwide, Nigerian shows more interest in the asset than in any other country in the world. The country had a transactional value of $34.4 million in the Q2 of 2020 alone.

With many developments happening across various blockchain industries, the crypto community may expect more surprises in the space. It is also clear that BTC is on track to reach various milestones.

Recommended for You