- SEC is planning to partner with CFTC to overlook regulations on digital assets.

- $3.35 B was collected as penalties from the leading crypto firms as per Elliptic.

Gary Gensler, the 33rd Chair of the US Exchanges and Securities Commission(SEC), has made proposals to collaborate with other government agencies like Commodity Futures Trading Commission(CFTC). This step is supposed to be taken for overseeing the regulation of digital assets.

Gensler in an interview expressed his opinion that all the rules and regulations of trading every coin or token should be compressed under a single roof. Irrespective of the pairs involved, be it security token or commodity token.

Gensler states:

“I’m talking about one rule book on the exchange that protects all trading regardless of the pair……”

SEC and Crypto Market

The interest of the SEC in the blockchain is said to have the same momentum as the bitcoin invention but the actions seem to be more intensified from this year’s start. The legal action implications on leading crypto and exchange platforms have hit the surface post the collapse of Terra stablecoin.

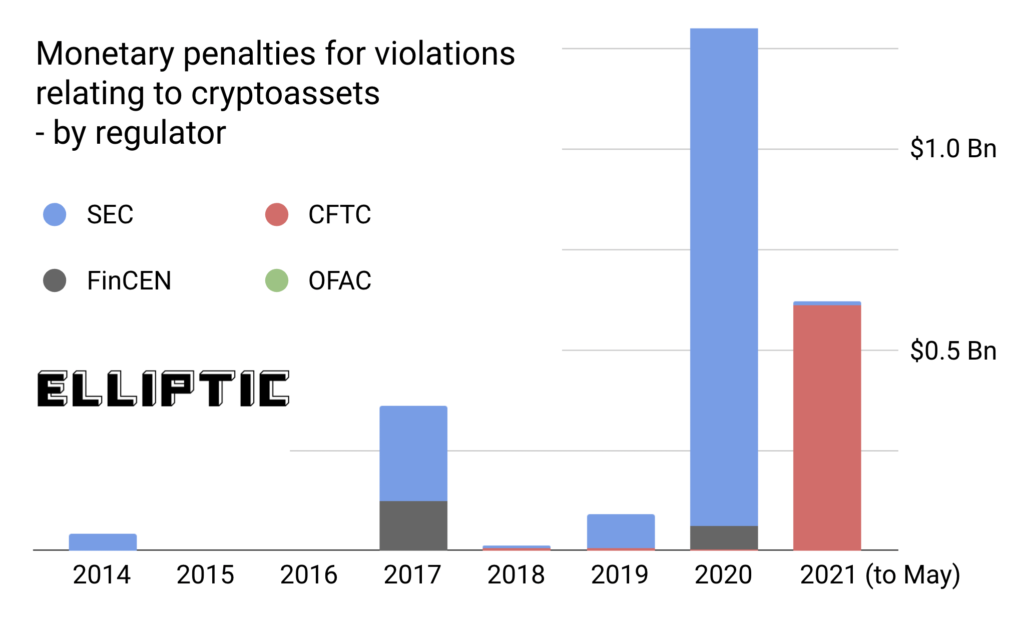

According to Elliptic, a British crypto analytics company, $3.35B has been collected as penalties from crypto firms. In which, $179.7M was just fined in the last 6 months as a crypto enforcement action.

Gensler is one of the vocal people in the SEC and he strongly believes that one rule book concept will help the crypto industry to move forward in the market with enhanced security for the public.

Recommended For You