- Blackrock has applied to create a spot Bitcoin ETF on Thursday.

- The SEC has not given the go-ahead for a spot bitcoin ETF to launch in the U.S as of yet.

After a rough couple of weeks, the cryptocurrency market is starting to trend upward again. After the interest rate decision by the U.S. Federal Reserve, the price of Bitcoin dropped below $25,000. The statements made by Fed Chair Jerome Powell prompted the sell-off, even though a halt to rate rises was good news for risk assets like BTC.

Given Powell’s hawkish comments, the pause in interest rate rises is likely to be short-lived. However, investors were hopeful that rising rates were coming to a halt. However, the Fed remains dedicated to its goal of 2% inflation.

Bitcoin’s price, which took a hit following the Fed statement, is back up to $25,500 on Friday after finding support around $24,700 and is up 2.48% in the last 24 hours.

Waiting for Approval from SEC

Several variables, including extreme oversold circumstances, have contributed to the recent rise in BTC prices. However, the report that Blackrock has applied to create a spot Bitcoin ETF may be the most important factor.

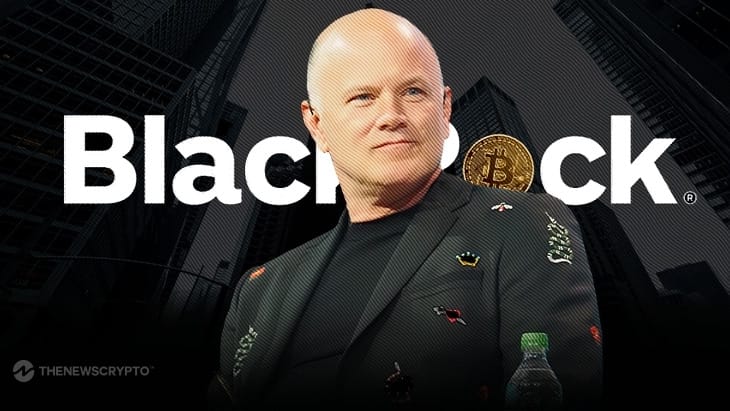

The world’s largest asset manager, Blackrock, took the first step toward securing one of the most sought-after crypto regulatory permits on Thursday. The business has submitted paperwork to the SEC in preparation for the launch of iShares Bitcoin Trust.

In the event that the ETF is approved, it will provide investors with a method to obtain exposure to the cryptocurrency market via a product offered by a major financial services firm on Wall Street. Bitcoin advocate Mike Novogratz of Galaxy Digital tweeted about the significance of this approval would begin to BTC.

Fun being on @LizClaman show!! And yes, @BlackRock getting a $BTC ETF through would be the best thing that could happen to $BTC. https://t.co/2fFBeB9eyo

— Mike Novogratz (@novogratz) June 16, 2023

The SEC has not given the go-ahead for a spot bitcoin ETF to launch in the United States as of yet. It is embroiled in a court battle with Grayscale over the latter’s attempt to transform its Grayscale Bitcoin Trust into an exchange-traded fund. This disagreement is expected to be settled later this year.