- Fidelity approximately holds crypto assets worth $4.5 trillion.

- The fall of every coin in the market has gone 50% below their ATH.

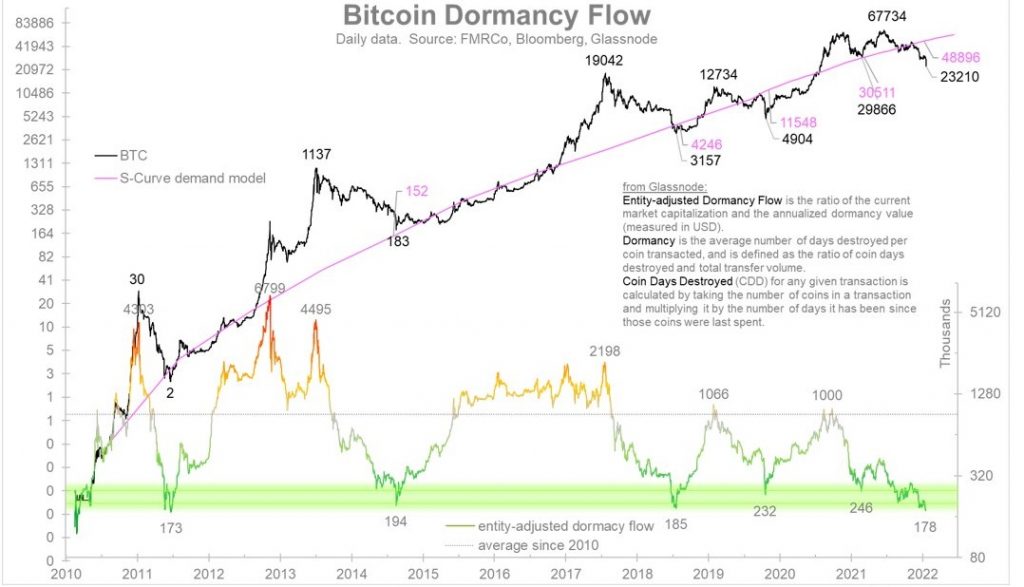

Jurrien Timmer, Director of Fidelity Investments, shows concern about the fact of bitcoin being oversold. Fidelity is one of the giant investors in the cryptomarket with a $4.5 trillion hold. Timmer portrayed his thoughts in the tweet with concerned charts and data.

Another way to highlight this is by overlaying Bitcoin’s non-zero addresses against its price. Price is now below the network curve. /2 pic.twitter.com/OVvm9NrBbY

— Jurrien Timmer (@TimmerFidelity) June 15, 2022

Timmer fears as the Dormancy flow chart by glassnode has gone below the limit set after 2011. The chart signifies the BTC ranges below the S-curve demand model and as per Timmer that is proof of how much it is being oversold technically.

BTC and Crypto Giants

Many crypto experts look into this ‘crypto-winter’ to be not worse than the previous decade once. As the price value of the crypto has only reached the 2020 limit. The current price of bitcoin is $21,970.61 and the current market cap is around $418 billion.

Dennis Porter, a famous bitcoin advocate, promotes BTC to be a crypto oasis. Since every other coin has fallen 70% below its ATH but BTC is confronting to maintain the present stand.

Lark Devis, another popular crypto personality, purchased BTC yesterday stating, that no matter what he has belief in BTC. He declared that he will forever be the bull in the crypto market and BTC will rebirth from its ashes like a phoenix.

Hodlers are very well confident too, one among the huge hodler is Michael Saylor, CEO of MicroStrategy. The firm has a history of holding 129k BTC as of now, and they say they will continue to buy too.

Recommended For You