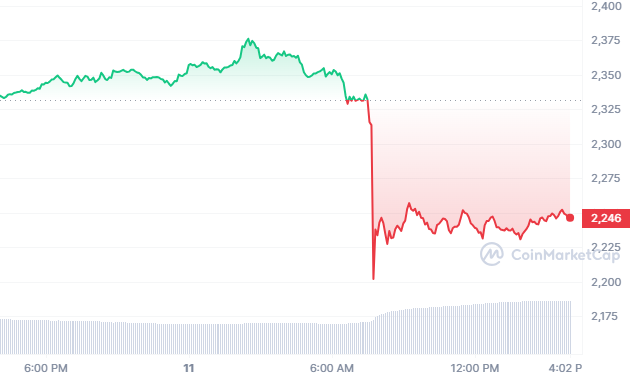

- At the time of writing, ETH is trading at $2246, down 3.84% in the last 24 hours.

- If the ETH price manages to go above $2301, then the price will likely test $2349 level.

Bitcoin and Ethereum were in the forefront of the substantial decline that occurred in the crypto market today. However, according to recent market statistics from Coinglass, there is a significant difference in trading activity.

Over $354 million was liquidated from long crypto traders in the previous 24 hours, while just $54 million was liquidated from short traders. Following a recent bullish flag pattern, this indicates a developing negative mood.

Despite investors’ concerns about the recent flash selloff of Bitcoin and altcoins, CoinShares reported a $43 million influx in their weekly cryptocurrency report. Bitcoin received the vast majority of fund inflows. Compared to Bitcoin’s $19.8 million influx last week, Ethereum witnessed an inflow of $9.7 million.

Investors Booking Profit

In Monday’s flash collapse, Ethereum’s price was among the hardest impacted. Since the price fell, it has trended low around $2,200 and was the first time it has happened in the last week.

The fact that big holders have been dumping is one of the most apparent reasons why the price of Ethereum dropped suddenly. Many investors made a profit this month as ETH reached its highest point in the previous year.

At the time of writing, ETH is trading at $2246, down 3.84% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is up 52.43%. The price has been consolidating post the recent flash selloff and finding support at $2202 level.

If the ETH price manages to go above $2301 resistance area then the price will likely test $2349 level. However, if the bears drive the price below $2202 level, then it will decline further to test $2198 support level.