- More than 40% of Ethereum’s circulating supply is now held at unrealized losses.

- Prominent holders like Erik Voorhees and Arthur Hayes are exiting ETH positions.

- Whale address 0x46DB accumulated 41,767 ETH despite $8.3 million paper losses.

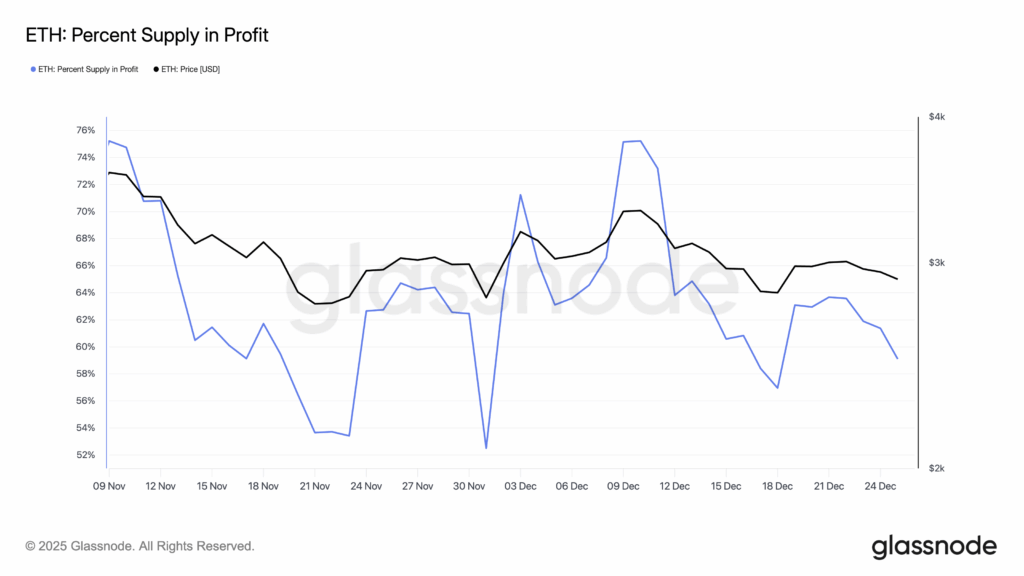

Ethereum holders are navigating difficult market conditions as December 2025 concludes. On-chain data reveals that over 40% of ETH’s circulating supply is currently held at a loss. The asset has posted three consecutive months of negative performance, with November alone recording a 22.2% decline.

December brought continued volatility for Ethereum. Despite briefly reclaiming the $3,000 price level, ETH failed to maintain support above this threshold and has since fallen back below it. The weakness has directly impacted holder profitability across the network.

Profitability metrics deteriorate across Ethereum network

Earlier this month, Glassnode data showed more than 75% of Ethereum’s supply was held at a profit. That figure has now dropped to 59%, indicating a rapid shift in holder positions.

The decline shows how quickly market conditions can change profitability for large portions of token holders.

The growing number of underwater positions has prompted different responses from major holders. Some are exiting while others continue accumulating despite mounting paper losses.

Prominent investors reduce Ethereum exposure

Erik Voorhees, founder of Venice AI, deposited 1,635 ETH worth approximately $4.81 million into THORChain to swap for Bitcoin Cash.

Lookonchain reported this transaction follows a similar move earlier this month when Voorhees swapped ETH for BCH from a wallet inactive for nearly nine years. The repeated transactions signal a clear portfolio shift away from Ethereum.

Arthur Hayes has also transferred ETH to exchanges. Hayes stated he is “rotating out of ETH and into high-quality DeFi names,” citing expectations that select tokens could outperform Ethereum as fiat liquidity conditions improve.

Winslow Strong, partner at Cluster Capital, transferred 1,900 ETH and 307 cbBTC to Coinbase totaling approximately $32.62 million.

An on-chain analyst noted the ETH was withdrawn one month ago at an average price of $3,402.25, while cbBTC was accumulated between August and December 2025 at $97,936.68 average. If sold, the total loss would reach approximately $3.907 million.