- Earlier this week, more than $181 million worth of ETH was transferred out of exchanges.

- If the price breaks below $1627 resistance level, then it will likely test $1569 level.

According to data compiled by Santiment, the average fee this week has been about $1.13, making it the lowest it has been since November 2022. Historically, ETH’s price has bottomed out and begun rising shortly after the Ethereum network fee has been around this level.

There has been no noticeable increase in the volume of transactions on the Ethereum network in spite of the decline. The figure has remained relatively stable recently at approximately 1,000k. To be more precise, this has been the case for well over a year.

Earlier this week, more than $181 million worth of ETH was transferred out of exchanges, amounting to approximately 110,000 ETH. Since August, this was the greatest daily outflow.

With a total of 115.88 million ETH, the amount of Ethereum stored off-exchange has hit a record high, while the amount of ETH accessible on exchanges has dropped to its lowest level in almost 5.5 years. Obviously, this is a promising new development. There is less possibility for sellers cashing out now that there are fewer ETH on exchanges.

Bears in Control

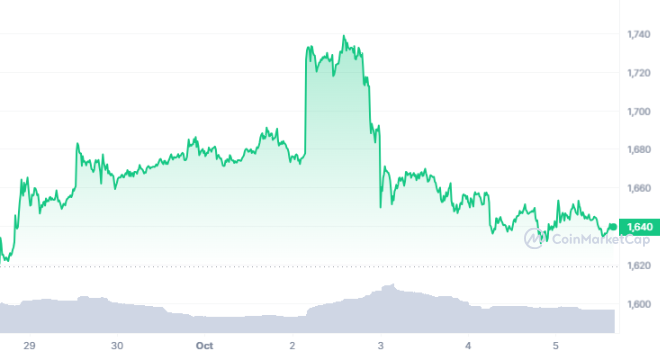

At the time of writing, ETH is trading at $1641, down 0.32% in the last 24 hours as per data from CMC. Moreover, the trading volume is down 11.47%. The price could not maintain the recent bullish momentum as bears took over.

If the price breaks below $1627 support level, then it will likely test $1569 level. Further decline might lead the price to test $1539 key support level. However, if the price manages to go past $1667 resistance level then it will likely test the $1735 mark.