- Ethereum rebounds past $3,150 despite geopolitical tensions, showcasing market resilience.

- Institutional approval for Bitcoin and Ethereum ETFs in Hong Kong drives demand.

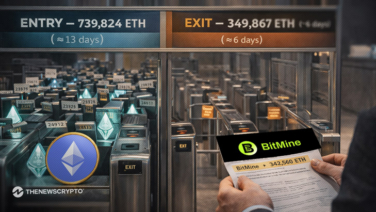

Ethereum (ETH) experienced a temporary dip below the $3,000 mark in escalating tensions in the Israel-Iran conflict. However, demonstrating remarkable resilience, the price of ETH has surged back, surpassing the $3,150 level at the time of reporting. This resurgence has been fueled by strategic moves from whales, who have been actively acquiring significant supplies from exchanges while capitalizing on market dips.

As of the latest update, Ethereum is trading at $3,246.19, marking a notable 5.18% surge, with the market cap experiencing a corresponding 5% increase. And a 31% decrease in trading volume.

On-chain data provided by Lookonchain highlights a noteworthy withdrawal of Ethereum from Binance, linked to a wallet associated with Matrixport. The transaction, totaling 16,300 ETH, equivalent to $51.1 million, occurred recently, adding to a series of withdrawals from exchanges by the same wallet since March 29. In total, the wallet has withdrawn 67,286 ETH, amounting to $228.33 million, signaling significant movement orchestrated by Matrixport, potentially indicating strategic maneuvers in the cryptocurrency market.

Furthermore, recent data reveals a decline in Ethereum Gas fees, with the median Ethereum Gas hitting as low as 12.5 gwei, the lowest level observed this year. Currently, Ethereum Gas stands at 8 gwei, indicating relatively lower transaction costs. However, blockchain activity has seen a surge on platforms such as Solana and Base, suggesting a diversification of interest among investors.

What’s Next For ETH?

In a significant development, prominent institutions including China Asset Management, Bosera Capital, and HashKey Capital Limited have announced the approval of their applications for Bitcoin and Ethereum spot ETFs by the Hong Kong Securities and Futures Commission. This approval allows investors to directly utilize Bitcoin and Ethereum to subscribe for corresponding ETF shares, potentially boosting demand for both cryptocurrencies.

In conclusion, Ethereum’s resilience amid geopolitical uncertainties, coupled with strategic maneuvers from whales and institutional adoption, positions it for further upward momentum. Investors are advised to monitor the ongoing developments closely as Ethereum aims to solidify its position in the cryptocurrency market.