- Investors are waiting for this week’s CPI data to confirm the market trend.

- The ETH price has recently broken the key support level at $1600.

All eyes are on the upcoming U.S CPI and PPI inflation release this week. It will set a benchmark for the FOMC to decide over the interest rate decision. Any favorable call will act like a strong catalyst boosting overall market sentiment. It can possibly lead to a much-needed market-wide recovery.

As the job market has cooled and the unemployment rate has increased, the U.S Fed is likely finished raising interest rates. As September is often the worst month for markets, investors are waiting for this week’s CPI data to confirm the market trend.

A whale recently made headlines by trading a huge amount of Ethereum for Bitcoin. Wrapped Bitcoin (WBTC) is a tokenized form of Bitcoin that operates on the Ethereum network, and the whale exchanged 5,500 ETH for 344.1 WBTC. Valued at over $8.85 million, this deal was substantial.

Bear Dominance

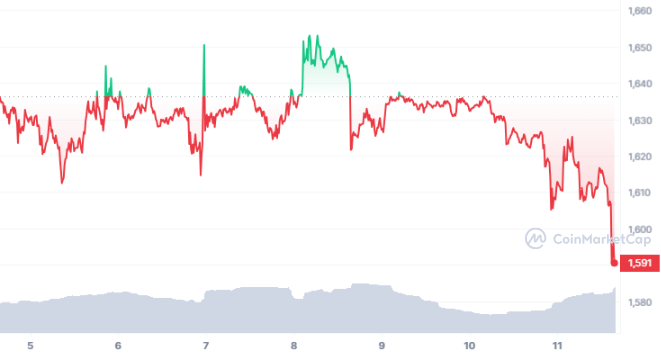

In recent weeks, Ethereum has been the subject to high volatility. Ethereum’s price has dropped 2.92% in the last 24 hours and is trading at $1591 as per data from CMC. The present market sentiment may be attributed to both the upcoming release of the consumer price index and the SEC’s delayed ruling on spot Bitcoin ETFs.

When examining the ETH price chart in more detail, we see that the price has recently broken the key support level at $1600. The price is likely to decline further all the way till the next support level of $1435. If this support is also breached then the price will likely test the $1100 support level. A severe downturn is on the cards if the price holds below the $1600 mark for a sustained period.