- At the time of writing, ETH is trading at $2018, down 1.59% in the last 24 hours.

- If the price manages to go above $2042 level, then it will likely retest the $2088 mark.

Institutional crypto products had their largest increase of inflows in two years, according to a recent report. Institutional investors have maintained a significant stake for the ninth consecutive week, according to CoinShares’ latest Digital Asset Fund Flows report.

The highly anticipated introduction of a spot-based ETF for cryptocurrency, most likely beginning with Bitcoin, is considered by CoinShares to have been the driving force behind the inflows. With $312 million, Bitcoin once again leads the list. While $34 million was poured into Ethereum last week.

Compared to similar Bitcoin crypto funds, this amount represents a meager 10% of the inflow. This discrepancy is especially interesting given the rivalry between BTC and ETH for spot exchange-traded fund (ETF) approval in the United States.

Struggle Continues

Nearly half of the way down from its all-time high of $4,800, the price of Ethereum has been fluctuating. However, amid market uncertainty, retesting the ATH looks like a formidable task.

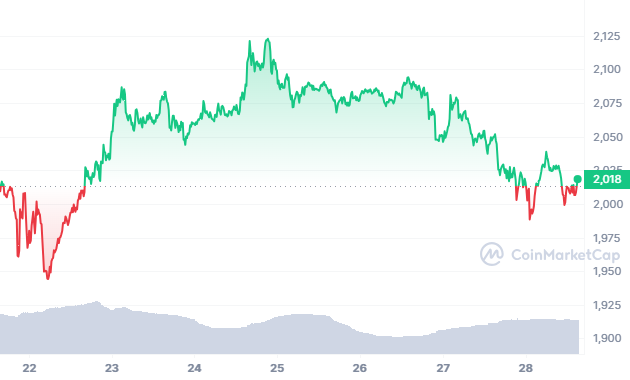

At the time of writing, ETH is trading at $2018, down 1.59% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is up 10.73%. The price yet again made a failed attempt to go above $2100 mark on November 24 and faced intense selling pressure.

If the price manages to go above $2042 level, then it will likely retest $2088 resistance area. Further push, will likely result in price retesting $2100 mark. On the other hand, if the price manages to go below $1967 level, then it will likely decline further to test $1916 support level.