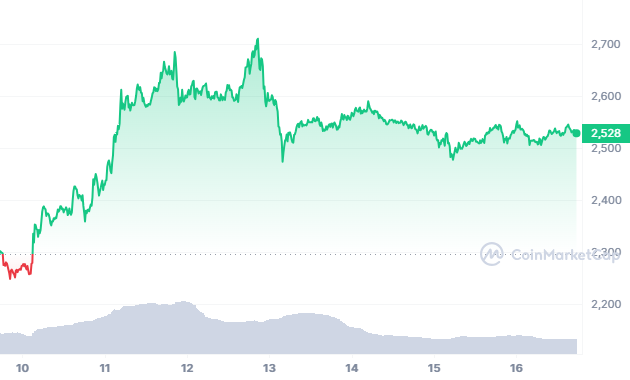

- At the time of writing, Ethereum is trading at $2527, down 0.46% in the last 24 hours.

- If the price manages to go past $2591 level, then it will likely test $2632 resistance level.

Glassnode statistics shows that the number of active validators on the Ethereum Proof-of-Stake (PoS) network reached a year-to-date low on January 12th. Decline started on January 4th, coinciding with a record-breaking 17,821 validators willingly leaving the network’s validator pool.

This pattern surfaced the day after leading crypto investment services firm Matrixport indicated that the U.S. SEC could reject all of the Bitcoin ETF proposals. The SEC is yet to decide on the Ethereum ETF with a deadline in May.

Consolidation Phase

The Ethereum price is currently exhibiting a correction, and there are patterns that suggest a rally may not only be on the horizon but could also be in continuation. The asset has recently experienced a sharp downturn, movement that is readily apparent on intraday time frames.

Amidst a lengthy consolidation period, several crypto analysts have predicted that Ethereum (ETH) is prepared for a substantial rebound. Analysts predict that Ethereum is about to break out of its current trading zone and hit the $3,500 mark.

At the time of writing, Ethereum is trading at $2527, down 0.46% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is down 13.23%. The price has been consolidating after making a failed attempt to clear above $2711 mark and faced brief correction.

If the price manages to go past $2591 level, then it will likely climb further to test $2632 resistance level. On the other hand, if the price goes below $2465 level then it will likely decline further to test $2358 support level.