- A total of $280 million, or 2.2% of the AuM, was lost over the course of the nine weeks.

- Since the beginning of December, ETH’s value has fallen by almost 35 percent.

Early this morning, ETH, the second-largest cryptocurrency globally, finally began to go north. In fact, it gained more than 6% in only one day, and that was enough to push it beyond the stiff barrier at $3000. Despite the coin’s position near resistance, positive momentum took over, and it can be relatable to this week’s reversal in investment product flows.

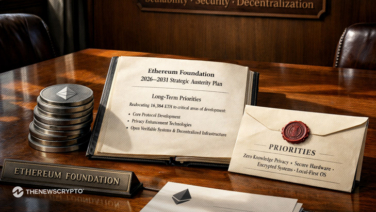

Investors Turn Optimistic

Ethereum witnessed $21 million in inflows during the week ending February 11th, after nine weeks of withdrawals from its investment products. CoinShares‘ latest report shows that investors are now optimistic. A total of $280 million, or 2.2% of the AuM, was lost over the course of the nine weeks.

Like other assets in its class, the cryptocurrency’s price fluctuated over this period. Since the beginning of December, ETH’s value has fallen by almost 35 percent. In the wake of the support found just above the $2800 level, ETH/USD moved higher on Monday. We’d say the short-term prognosis is good as long as the cryptocurrency is trading above both of those levels.

We would want to see a decisive decline below $2577 before we can abandon the optimistic argument and start looking at whether the bears are back in charge. On January 27th and 28th, support was found around the $2352 area, which might again support if the price starts falling.

According to CoinMarketCap, the Ethereum price today is $3,124.94 USD with a 24-hour trading volume of $14,346,191,759 USD. Ethereum is up 5.99% in the last 24 hours.