- In recent times, the price has been consolidating within a narrow band.

- A further decline is more likely, unless a major catalyst turns the table around.

According to a recent tweet by Glassnode alerts, an on-chain monitoring tool, the volume of Ethereum (ETH) withdrawals from exchanges has hit a one-month low. The report claims that the number of ETH withdrawals (7d MA) from exchanges has hit 3,109,756. This new low comes after the measure only yesterday hit its lowest point in a month.

There has been a dramatic down trend in the crypto market, with Ethereum (ETH) in the forefront. However, Glassnode claims that the actions of Uniswap LPs indicate a high degree of optimism over the price of ETH.

The 8.6% bullish slant of the market’s liquidity is much larger than the -2.7% bearish slant. The recent $8.3 billion in ETH futures and options volume is the largest since the Shanghai Upgrade. Moreover, this week, Grayscale Ethereum Trust (ETHE) saw its discount to NAV shrink to its lowest level in a year.

Further Decline Anticipated

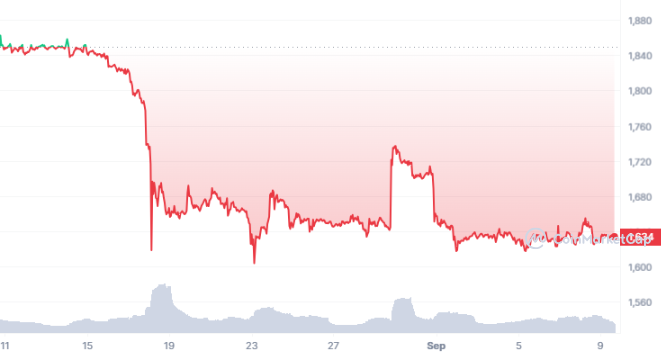

At the time of writing Ethereum is trading at $ $1633, up 0.44% in the last 24 hours as per data from CMC. In recent days, the price has been consolidating within a narrow band. Moreover, a sharp collapse to about $1100 is anticipated if the price manages to break below the crucial support level of $1600.

On the other hand, a significant rally towards the $2,000 mark is expected if the price manages to break over the $1738 resistance level. Amid the ongoing market sentiment, a further decline is more likely, unless a major catalyst turns the table around.