- Ethereum surges past $3,600 with $43B daily trading volume

- Altcoin Season Index reaches 61/100, nearing critical threshold

- Technical indicators suggest potential push toward $4,093

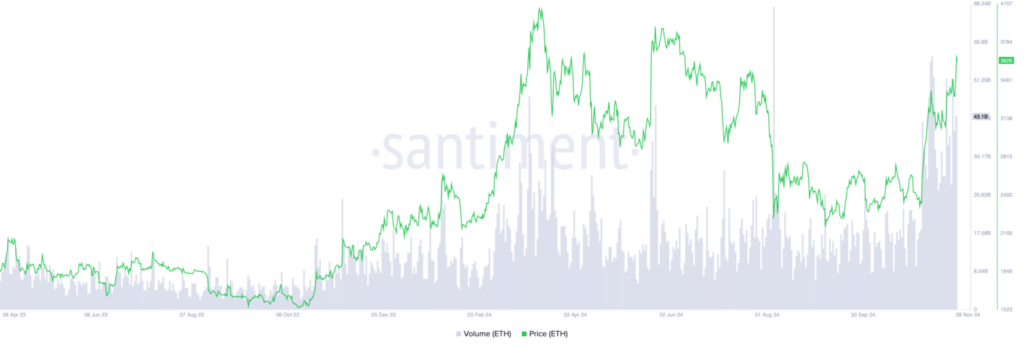

Ethereum (ETH) has achieved a significant milestone, breaching the $3,600 mark for the first time since June. The second-largest cryptocurrency by market capitalization currently trades at $3,613, supported by an extraordinary surge in trading activity that suggests sustained bullish momentum.

The remarkable trading volume of $43 billion over the past 24 hours provides strong validation for the price movement. This substantial market participation is particularly significant because it demonstrates genuine buyer interest rather than speculative activity. When trading volume rises in tandem with price, it typically indicates a more sustainable rally with broader market support.

The surge in Ethereum’s price coincides with growing evidence of an approaching altcoin season. The Blockchain Center’s Altcoin Season Index has reached 61 out of 100, edging closer to the critical 75-point threshold that traditionally signals the start of an altcoin market cycle. This development suggests potential for further upside as market attention shifts toward alternative cryptocurrencies.

Ethereum holders show profit-taking as price surges

However, some profit-taking has emerged in response to the price increase. Exchange netflow data reveals that 54,974 ETH (valued at over $199 million) moved to exchanges on Wednesday, potentially indicating selling pressure. While this movement typically suggests incoming supply to exchanges, the overall market sentiment remains decidedly positive.

Technical analysis supports the bullish outlook, with the Parabolic Stop and Reverse (SAR) indicator showing favorable positioning below the price curve.

This technical formation suggests continued upward momentum, with potential for ETH to challenge resistance at $3,669 before targeting its year-to-date high of $4,093. Nevertheless, traders should remain mindful of the $3,336 support level, which could come into play if buying pressure subsides.

The convergence of strong trading volume, technical indicators, and broader market cycles presents a compelling case for Ethereum’s continued appreciation, though careful attention to exchange flows and support levels remains crucial for traders navigating this dynamic market environment.