- ETH is Price trading near $3,000, with price movement staying within a narrow daily range.

- Market activity suggests consolidation, as technical indicators and ETF flows show mixed signals.

Ethereum (ETH) is trading near $3,004, showing a modest gain over the past day as price action remains around the $3,000 level. Over the last 24 hours, ETH moved between an intraday low of $2,916.22 and a high of $3,040.72, while its market capitalization stands at $362.66 billion and trading volume is around $26.56 billion. This reflects ongoing interest in the asset even as broader market dynamics evolve.

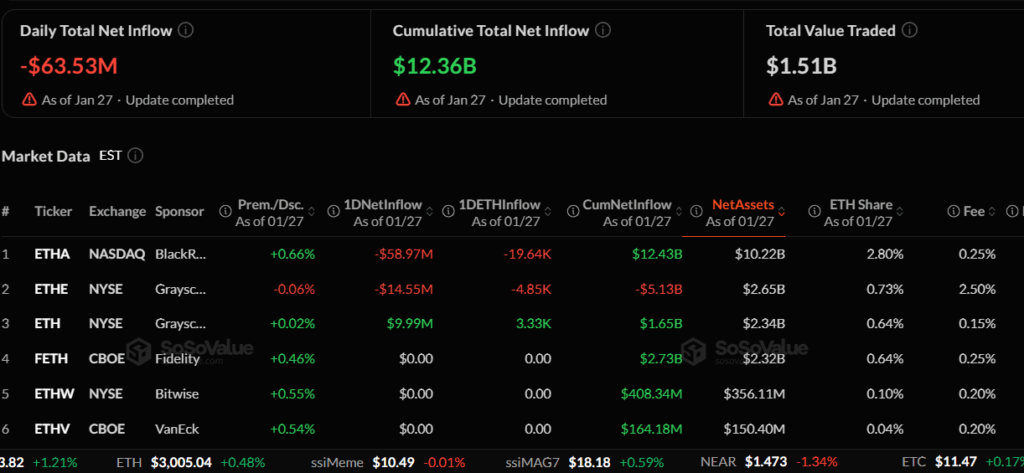

Meanwhile, institutional flows into Ethereum’s exchange-traded products remain a key focus. According to the latest data SoSoValue, the total net flow for January 27 showed a net outflow of about $63.53 million, with BlackRock’s ETHA fund accounting for the largest portion of that outflow.

At the same time, some other products, such as the Grayscale Ethereum Mini Trust ETF, recorded smaller net inflows, but they were not large enough to offset the overall outflow figure. The cumulative total net inflow into Ethereum spot ETFs now stands near $12.36 billion since these products launched.

Ethereum Trades Near $3,000 as Price Action Remains Range-Bound

On the weekly chart, Ethereum is still trading below its 9-week moving average (near $3,050) and below the 21-week moving average (around $3,515). This suggests that medium-term trend momentum remains subdued. Weekly price action has seen lower highs after peaks near $3,800, indicating that sellers have been active at higher levels and the broader structure has not yet turned decisively upward. The lack of a fresh bullish crossover keeps upside momentum restrained for now.

The RSI (14) on the weekly timeframe sits around 44–45, below neutral levels. This highlights a lack of strong momentum in either direction, with buying and selling pressures broadly balanced. Meanwhile, the MACD indicator remains below its signal line with the histogram in negative territory, pointing to continued range-bound conditions rather than a firm trend reversal.

Zooming in, The Bull Bear Power Trend (BBPT) shows reduced bearish pressure, but bullish strength is still limited. This aligns with the current sideways movement.

Looking at short-term price action, daily charts show ETH consolidating above $2,900, with buyers defending dips and sellers stepping in near resistance levels. From a longer-term perspective, Ethereum remains above several key support bands but below major resistance zones formed earlier in the year, reflecting a period of correction and consolidation following earlier gains.

In the near term, support is seen near $2,900, while resistance is located around $3,150–$3,200. Until price clears these levels with conviction, ETH’s movement is likely to remain range-bound, shaped by both technical levels and broader market flows.