- DeFi liquidity provider, Balancer has estimated TVL of $1.56 billion.

- Balancer’s mainnet Ethereum TVL is $1.43 billion, which increased by over 6,71%.

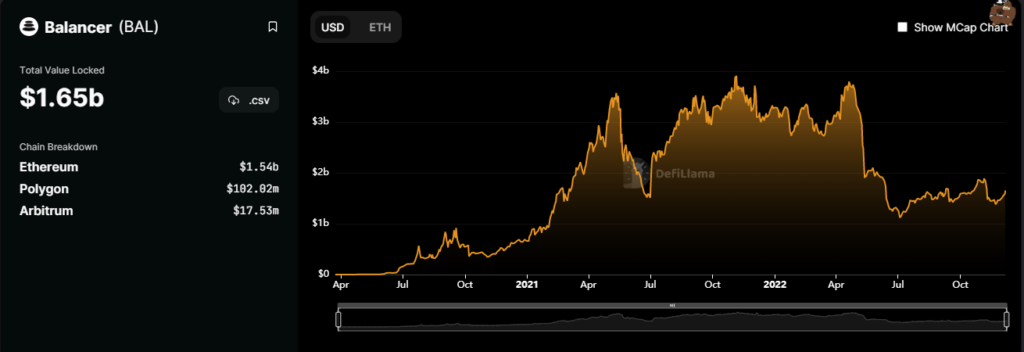

Just now, the Ethereum-based DeFi liquidity provider, Balancer ($BAL) revealed a report on its TVL (Total Value Locked) which is estimated to be $1.56 billion. The Balancer is one of a well-known Decentralized “Automated Market Makers” (AMMs) on the Ethereum network that lets users quickly swap tokens and be rewarded for offering liquidity to various pools.

The Balancer Labs, which was initially developed in the year of 2018 by Mike McDonald & Fernando Martinelli launched their bronze release, which is followed by the rest of the three phases in march 2020, raising about $3 million as seed funding.

Balancer’s TVL

Balancer’s TVL is $1.56B which is distributed as follows, The total mainnet TVL is now at a whopping $1.43 billion which surpassed about 6.71% from the $1.34 billion from the previous week, followed by Polygon, Arbitrum and Beethoven X’s Optimism.

#DefiForAll @0xPolygon https://t.co/EwzdosWTGJ

— Sandeep | Polygon 💜🔝3️⃣ (@sandeepnailwal) December 5, 2022

A TVL is calculated by multiplying the total number of tokens by their current price. ‘Higher the TVL means higher the User engagement’ which in turn becomes proof of higher User benefits and credibility in the crypto space. Although a TVL doesn’t always accurately measure the value of a project, it acts as one of the metrics that predominantly helps to determine the value of a native token.

According to DeFiLlama, the overall TVL in all the Defi projects is estimated to be more than $42 billion. Moreover, during furnishing this article, Balancer ($BAL) traded at $6.31 with a 24 hours trading volume of $67 million, which surged about 1117%, as per CoinMarketCap.