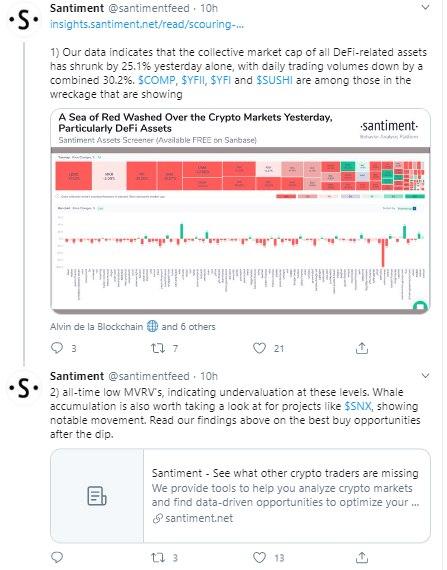

The decentralized finance (DeFi) assets have continued to fall by 25.1% while volumes shrunk 30% in the last 24 hours alone according to data from Santiment.

Santiment estimated that daily DeFi token trade volumes have dropped by 30% combined. However recent market leaders Sushi (SUSHI), Yearn Finance (YFI) and Uniswap (UNI) are among the hardest hit. With weekly losses of 51%, 31% and 38% respectively.

The report reads,

The crypto market has been engulfed in a sea of red this week, with most DeFi blue chips recording double digit losses over the past 7 days.

However noting that crypto-Twitter has already emphatically explained the death of the whole DeFi project. Santiment claims to have identified whale accumulation activity taking place around several DeFi assets including Synthetix (SNX).

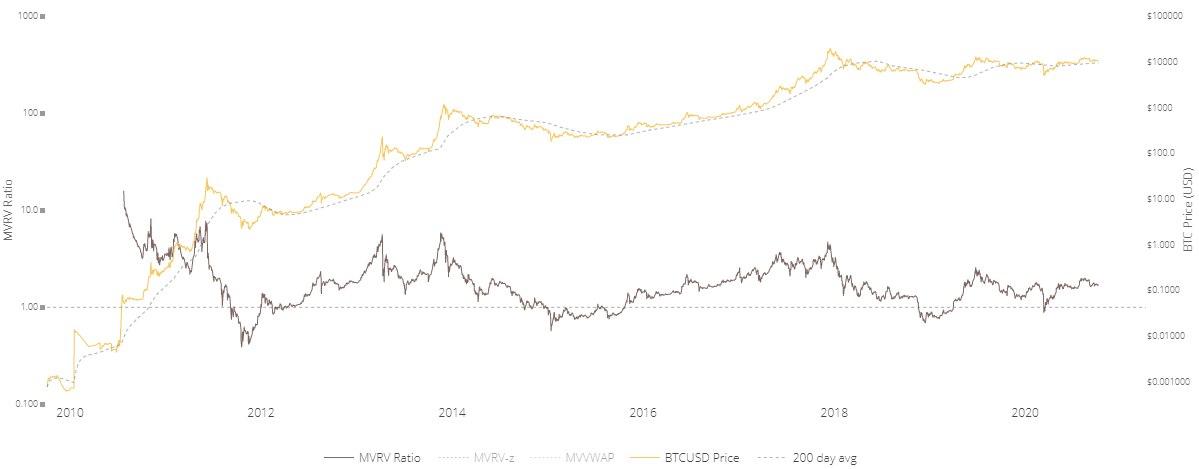

Santiment also mentioned that the combined price of DeFi assets. At the time they last moved on the MVRV blockchain has decreased. To an all-time low, “indicating undervaluation” at current price levels.

More like Bitcoin peaked to $20,000 in a rapid climb in 2017 on a speculative aspect, the coin then fell and faced a bearish market for more than 18 months. The same may happen with DeFi. It could drop down to a low point, but then rise up again in a sustainable manner.

Recommended for You