- FTX’s plans to sell $3.4 billion worth of its crypto holdings, including SOL, ETH, and BTC.

- FTX aims to sell $200 million worth of crypto assets weekly.

- ApeCoin would face a potential impact on Sep 17, with 11% of outstanding tokens set to unlock.

The cryptocurrency market has once again experienced a significant surge in volatility following the news of FTX’s impending sale of its crypto holdings, totaling $3.4 billion. This move has placed immense selling pressure on FTX’s major holdings, including Solana (SOL), Ethereum (ETH), and Bitcoin (BTC).

FTX administrators have successfully recovered approximately $7 billion in assets, with $3.4 billion of this value being held in cryptocurrencies. According to recent filings, a court hearing scheduled for Wednesday will evaluate a proposal to initiate token sales as part of the creditor repayment plan.

Altcoins at Risk

FTX intends to liquidate at least $3.4 billion worth of cryptocurrencies to facilitate the return of fiat currency to its users instead of tokens. This action is expected to have a prolonged impact on the crypto market. Throughout the remainder of the year, as noted by Matrixport, a crypto services provider.

Matrixport has pointed out that FTX has intention to sell $200 million worth of crypto assets each week. Notably, FTX holds a substantial amount of Solana with close to $1.2 billion in SOL. FTX’s crypto asset inventory also includes $560 million in Bitcoin, the largest cryptocurrency, and $192 million in Ether, the second-largest cryptocurrency.

FTX isn’t the sole major seller in the crypto market at the moment. VC Investors are also facing significant pressure to return funds to their investors, leading them to become substantial sellers of altcoins. Markus Thielen, head of research, emphasized the importance of these VC funds in shaping market dynamics.

The upcoming unlock of ApeCoin (APE), another crypto held by VC investors, scheduled for September 17. This event will account for 11% of outstanding APE tokens, potentially further impacting prices following a 4.2% unlock on August 17, which resulted in a 24% price drop.

On the technical front, Bitcoin has formed a death cross, indicating increased volatility. This occurs when the 50-day short-term moving average breaches the 200-day short-term moving average, potentially leading to further turbulence in BTC’s price in the coming days.

Ethereum has also faced challenges, hitting a five-month low on early September 12 and experiencing a 15% drop to $1,533.

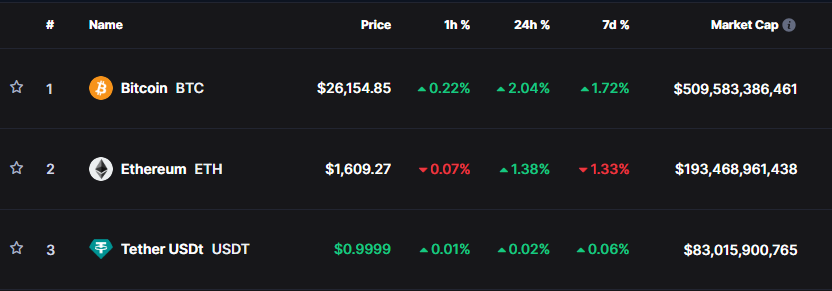

Despite these challenges, at the time of writing, the crypto market is showing signs of a slight recovery. Bitcoin’s price has risen by about 2% to $26,154, Ethereum (ETH) has surged by 1.4% to $1,609. And Solana (SOL) has climbed over 4% to $18.34.