The crypto global market has witnessed plenty of developments and twists in the year 2024, right from Bitcoin’s long-awaited goal of $100K to even the approval of Bitcoin ETFs.

January: The SEC Approves Bitcoin ETFs

The U.S. SEC has approved 11 Bitcoin ETFs. Now, the investment community can own the assets indirectly through ETFs without necessarily buying and owning a bitcoin. Similar to a stock fund, this means people do not need digital wallets or platforms such as Binance or Coinbase to buy their share of cryptocurrencies.

It has been considered the biggest step for the crypto industry, especially for large firms such as BlackRock and Fidelity, which backed the move. The approval increases the accessibility of Bitcoin to everyday investors and strengthens institutional confidence.

However, the SEC cautions that Bitcoin investing still involves risks like market manipulation and fraud. While this decision simplifies Bitcoin investment, potential investors are urged to remain cautious. It’s a big win for mainstream crypto adoption but with a reminder to proceed carefully.

Anyhow Gargensler tweeted it was not official.

What This Means for Bitcoin’s Price

In 2022, the price of Bitcoin went to $16,000. Immediately after the announcement by the SEC, the price of Bitcoin jumped to about $46,500. According to experts, this ETF will inflow billions of dollars into the market and could push Bitcoin’s price up to $100,000.

According to some predictions, with the approval of ETF, the market might see $50 to $100 billion in new investments this year. But others fear that ETFs could make Bitcoin even more volatile and riskier, especially for retirement savers. While ETFs may stabilize the market, they may increase risks for ordinary investors.

February: Telegram Launched Tap-to-Earn

Tap-to-earn games in the Telegram application are among the most trending for 2024, attracting significant audiences and valuations. Contrary to the play-to-earn concept, tap-to-earn is free, and one requires only a smartphone and some tapping to earn rewards. These games are simple, easy to access, and derive money from advertisements rather than from new players. But critics claim the games might end up feeling shallow, and the players could get bored easily if there is nothing deeper to experience.

Now is the time of change for Web3 gaming because people can easily enter games with zero financial risk. From NOT COIN to Hamster Kombat revolution. Since the games are somewhat simple, ad-dependent, the long-term future is not sure. However, there are several projects trying to improve features and diversity. Large market caps and almost zero profit.

March: Bitcoin Hits $73,097

Bitcoin has reached a record-breaking all-time high of $73,097, fueled by the rising adoption of Bitcoin ETFs and growing interest from institutional investors.

AI Tokens

AI tokens are rapidly gaining attention in the crypto industry, by the excitement surrounding OpenAI’s Sora, a technology that creates hyper-realistic videos from text prompts. Major AI-based projects like Fetch.ai, SingularityNET, and Bittensor (TAO) are on the top list, with Bittensor holding the first place in the AI token market with a market cap over $25 billion. Bittensor is an open-source protocol that uses blockchain to build a decentralized machine-learning network. Render (RNDR) and Fetch.ai (FET) also have gained significantly, with Render peaking at $13.50 and Fetch.ai at $2.55, showing a strong performance in the sector.

As AI-driven projects continue to thrive, the AI coin market is experiencing rapid momentum. With NVIDIA’s growth being driven by AI, the market for computational power and blockchain solutions is expanding. Fetch.ai, Render, and Bittensor are all capitalizing on the increasing demand for AI in blockchain technology, offering decentralized solutions for tasks such as automating everyday activities and digital creation.

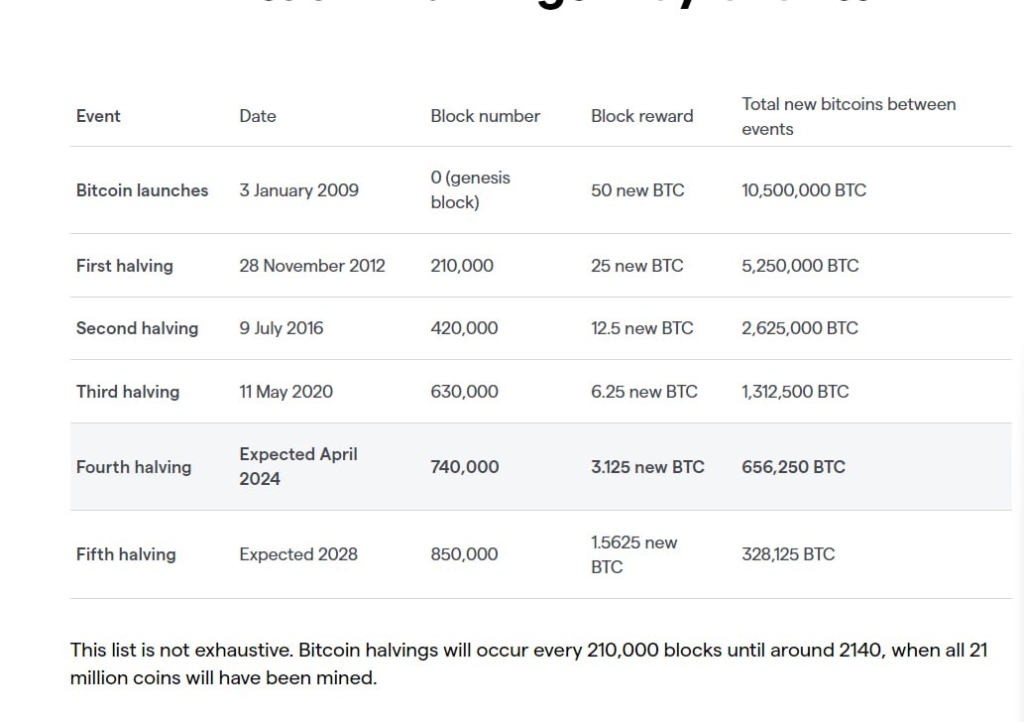

April: Bitcoin Halving Event

Bitcoin’s fourth halving occurred on April 19, 2024, reducing the rewards of its miners’ from 6.25 BTC down to 3.125 BTC, thereby increasing the scarcity of Bitcoin. This created so much market activity, with users spending more than $2.4 million in fees to secure transactions. The deflationary effect of the halving could have the long-term effect of raising Bitcoin’s price; nonetheless, its price is still at $64,000 to $65,000, with short-term ups and downs due to uncertainty in the market and Federal Reserve decisions.

The halving has directly affected miners by cutting down their revenues, which might alter the mining scenario. In the past, Bitcoin’s price had risen after the halvings, but this time, regulatory and market factors may alter the trend. Experts believe that the halving, along with that development, among others.

May: Ethereum ETF Approved

Following the approval and launch of Bitcoin Exchange Traded Funds (ETFs) in January 2024, the U.S. Securities and Exchange Commission (SEC) approved eight Ethereum ETFs for listing and trading on SEC-regulated exchanges on May 23, 2024.

July: WazirX Hack

In July 2024, Indian crypto exchange WazirX suffered a massive cyberattack, losing $235 million. Hackers were still able to breach the secure multisig wallet system of WazirX even though it had a Gnosis Safe wallet, which requires 4 out of 6 signatures, whitelisted addresses, and hardware wallets. The hackers manipulated the system by changing the wallet to a malicious smart contract, which bypassed both the multisig and the whitelist. They also manipulated how the transaction would look so that the required signers were deceived into signing it.

This hack illustrates how challenging securing Web3 projects can be, even with state-of-the-art safeguards. It underlines the need for deep security audits and continuous improvements in security systems to prevent such advanced attacks in the future.

August: Market Crash

he sharp market crash on 5 August 2024 was driven by a combination of factors, primarily the unexpected rate hike by the Bank of Japan and a concerning US job report. The rate hike disrupted the yen carry trade, leading to a sell-off in global markets, with significant losses in major indices like the Nikkei 225 and Nasdaq.

Weak US jobs data that also reported a less-than-expected payroll growth and a rising unemployment rate, intensified the recession fears. It was a global economic signal with a mix that led to very dramatic rises in market volatility and was well demonstrated by the spikes of the Cboe Volatility Index, VIX.

The impact on the markets spread beyond stock into forex and commodities markets, underlining the interrelated nature of the financial systems around the world. The US dollar fell as the market rebalanced its bets on Federal Reserve rate cuts, while the yen gained as Japan’s policy turn shifted. Commodities such as copper, gold, and crude oil also tumbled, echoing a general unease in the economy. However, the volatility in markets is anticipated to continue until markets adjust to the changes. Data on key upcoming US CPI and jobs reports would play a vital role in how the market behaves in the coming days.

Token2049 September

Token2049, scheduled for September 18-19, 2024, at Singapore’s Marina Bay Sands, is all set to become one of the biggest global events in crypto and Web3. More than 20,000 attendees from 150 countries with 500 side events across a week from September 16-22 will get to listen to some of the biggest leaders, such as Balaji Srinivasan, Binance’s Richard Teng, and Solana’s Anatoly Yakovenko. Outside of talks, visitors can participate in interactive experiences like AI-generated art, virtual reality, and even padel and rock climbing for an entertaining, participatory experience.

What makes Token2049 different is its focus on community and inclusivity within Web3. Some of the event’s options include the Women in Blockchain Alliance Breakfast and Borderless Summit with the aim of making a space that is quite exclusive in the crypto world, more diverse and inclusive. Held during the Formula 1 Singapore Grand Prix, the event will be a unique mesh of high-octane racing and cutting-edge blockchain tech. Token2049 is one that unifies the world of cryptocurrency and forges the future.

November: Trump Wins Presidency

Donald Trump, a strong proponent of crypto, emerged victorious in the U.S. presidential election. His victory created shockwaves in the crypto market, with most investors being optimistic about his administration. Many believed that his administration would be lenient in terms of regulations, cut taxes for cryptocurrency mining operations, and perhaps even create a national Bitcoin reserve.

These potential changes were viewed as a major boost for the crypto industry, fueling expectations of a more favorable environment for digital assets and further driving market confidence.

December: Bitcoin Crosses $100,000

Bitcoin reached a huge milestone by breaking through the $100,000 mark and reaching a new high of $105,000 by December 4. This surge with open interest in Bitcoin futures exceeding $40 billion. The record price gave Bitcoin the stature of a global asset and strengthened interest in the cryptocurrencies as a viable alternative investment. This marked a milestone that not only defined the victory for Bitcoin. But also cemented its growing dominance in the financial space, garnering more attention from institutional and retail investors alike.

National Bitcoin Reserve Proposed

The Trump administration proposed the introduction of a national Bitcoin reserve, where this would be sort of a gold reserve but, in this case, with Bitcoins as part of the U.S. monetary system. In this same time frame, more than 132 countries tested or introduced Central Bank Digital Currencies with China leading on its digital yuan, making the digital yuan accessible to 260 million wallets within 25 cities in China, Europe started testing its digital euro. Exactly as VanEck had predicted.

Impact: These developments marked a significant shift in the global financial landscape, with Bitcoin gaining legitimacy as a sovereign asset and potentially becoming a cornerstone of future economic policy. The growing adoption of CBDCs highlighted the increasing importance of digital currencies backed by governments, potentially reshaping global financial systems. This convergence of the national reserve Bitcoin and the newly emerging CBDCs has started questioning the future money, privacy issues with the adoption of digital currencies within cross-border, and the position it will give the Bitcoin as central to the emerging monetary system.

FED rate cuts

Federal Reserve Jerome Powell announced two quarter-point reductions in the future, reducing Fed funds to 4.50%. However, he also made clear that the Fed is not allowed to own Bitcoin and has no plans to change laws regarding cryptocurrency ownership. Powell’s comments caused a major shake-up in the crypto market, with Bitcoin dropping below $100K, hitting around $98,000. While the rate cut was expected, Powell’s cautious stance on future cuts and his dismissal of Bitcoin as part of the central bank’s reserves. Which dampened investor confidence, sending Bitcoin and other major cryptocurrencies into a decline.

The crypto market reacted strongly to Powell’s remarks. And with Bitcoin dropping over 6% and other coins like Ethereum, XRP, Solana, and Dogecoin losing value. The total market value of cryptocurrencies fell by 4%, down to $3.5 trillion, and traders saw heavy liquidations.

Despite this, Bitcoin recovered a bit and had gone up to surpass $101,000. It reached a record high of $108,000 earlier in the week. Meanwhile, pro-crypto President-elect Donald Trump promised to make the U.S. the “crypto capital of the planet, weighing in as other investors mull over the implications of both leaders’ stances.”.