In an almost anticlimactic turn of events after Trump’s inauguration, Bybit, the second-largest cryptocurrency exchange in the world by trading volume, presented the most recent weekly crypto derivatives report in partnership with Block Scholes, acknowledging the muted optimistic mood in the crypto markets.

With the Trump family meme coins TRUMP and MELANIA, the 2025 presidential inauguration set off a wild weekend of speculation that swung derivative markets in a strong direction. But when the expected presidential actions pertaining to crypto did not come to pass, implied volatility decreased while actual volatility increased. The complicated speculative climate as political uncertainty and cryptocurrency’s optimistic expectations collided was reflected in the perpetual and options markets, which continued to have high funding rates and a persistently positive skew.

Important Takeaways:

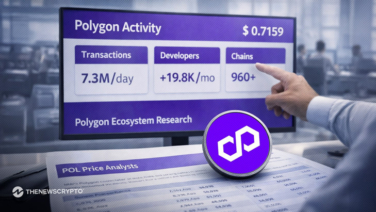

SOL’s Highlight: As traders awaited crypto-friendly regulations, Trump’s release of “husband and wife” coins caused Solana perpetual swaps to reach an all-time high. The introduction of the TRUMP meme currency on Solana DEXs increased the network’s fee generation and placed it in a symbolic position superior to Ethereum’s rivals.

Sources: Block Scholes and Bybit

Derivatives Market Resilience: Open interest indicated steady positions, while perpetual swap financing rates were neutral to optimistic despite little reports of a crypto-positive inauguration. The occurrence was seen by derivatives markets as one of many possible catalyst possibilities.

BTC Options Speculation: Strong call purchasing and the greatest at-the-money term structure inversion since the November 2024 election were the outcomes of earlier expectations of a possible strategic BTC reserve, which led to considerable short-tenor options posture. There is still a significant bias for out-of-the-money calls even though front-end volatility pricing has decreased.

Get the whole research report here, which includes a thorough examination of financing rates, options market dynamics, and volatility patterns.