- On-chain data provider CryptoQuant put out an investigation analyzing Binance’s status.

- The Net Flow-Reserve Ratio statistic shows that net flows are consistent with past patterns.

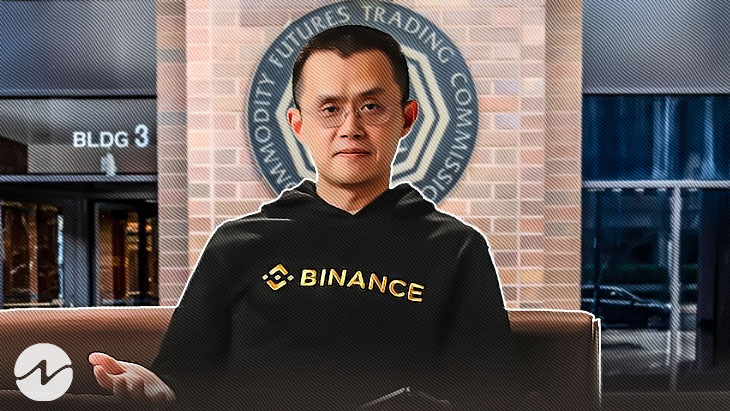

The United States Commodity Futures Trading Commission (CFTC) has launched a lawsuit against Binance, the biggest cryptocurrency exchange in the world, and its CEO “CZ,” alleging that they have broken regulations pertaining to cryptocurrency trading and derivatives. When combined with the increased attention and crypto governmental crackdowns that followed FTX’s demise, this increased the levels of FUD around Binance.

After the U.S. CFTC complaint, on-chain data provider CryptoQuant put out an investigation analyzing Binance’s status. During regulatory FUD after the FTX crash, the BUSD crackdown, and the CFTC litigation, the netflows and reserves of Bitcoin, Ethereum, and stablecoins were compared.

Consistent With Past Patterns

Binance’s net outflows peaked at 40,353 BTC on December 12 during the regulatory FUD that followed the FTX incident. In addition, there was a net outflow of 78,744 BTC from the market between December 10-16.

However, on February 12, during the BUSD FUD, Binance had a record-breaking daily net outflow of 5,027 BTC, and daily net outflows of 4,505 BTC followed the CFTC complaint. As a result, the current Bitcoin outflow is modest in comparison to past occurrences.

The overall net outflows of Ethereum have been decreasing, similar to the trend seen in Bitcoin. On December 12, during the regulatory FUD, Binance had a day net outflow of 278k ETH, the largest of the year.

After the BUSD FUD and the CFTC lawsuit, daily net outflows of 79,706 ETH and 76,146 ETH, respectively, occurred. According to CryptoQuant, the Net Flow-Reserve Ratio statistic shows that recent net flows are consistent with past patterns.

Recommended For You: