- BNB is accused of being security and Binance has broken the law by selling it.

- Binance US states it follows all laws imposed by the US regulatory.

The US Securities and Exchange Commission(SEC) has keen eyes on Binance now. The native token BNB is accused of being security and the firm is said to have broken the law by selling them. The SEC is also questioning various factors and the functioning of the exchange platform.

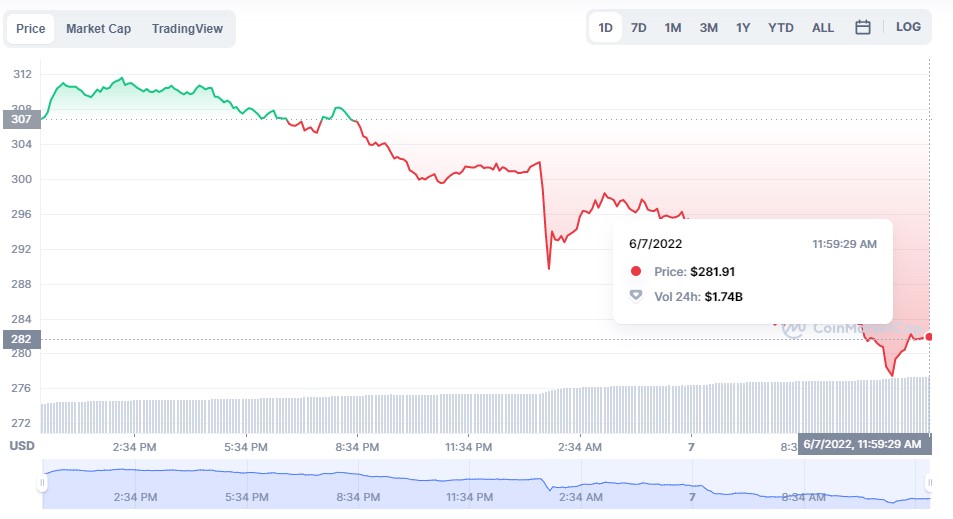

Binance is the largest exchange platform at cryptoworld today and BNB is the fifth largest in the market. The current price is $281.91 and the market capitalization is over 46 billion dollars, as per CMC. The impact of SEC radar can be seen in the price drop of the token.

Crypto analysts sense it to be a deja vu moment, the Ripple’s XRP was also accused of the same by SEC and the firm is fighting legally against them now. It is to be noted that the SEC has mentioned informally in the past that cryptocurrencies are not securities.

A Look into Past

The BNB was launched five years ago in 2017, and the company announced in its official document that the maximum circulation threshold will be 200 million and the Initial Coin Offer(ICO) would be 100 million. Also, they stated that more than 85% of capital gained from ICO will be put into use for their global exchange development.

Binance has segregated the platform, especially for US users in the name of ‘Binance. US’, and ‘Binace.com’ for people outside the US. The former confirms that they follow all the rules and regulations set by the SEC.

The firm states:

“Binance.US is a separate US-focused trading platform that services US users by offering products and services that are compliant with US federal and state regulations”