- Bitcoin, benefiting from these developments and progress in U.S. stablecoin legislation, has reached a new all-time high, up 17.8% year-to-date.

- This surge was influenced by easing global trade tensions, advancements in stablecoin legislation, and shifting investor sentiments amid fiscal uncertainties.

The cryptocurrency market witnessed significant developments in the week leading up to May 23, 2025, with Bitcoin reaching a new all-time high. This surge was influenced by easing global trade tensions, advancements in stablecoin legislation, and shifting investor sentiments amid fiscal uncertainties, as mentioned in the Binance Research’s Weekly Market Commentary report.

Market Overview

Recent progress in U.S.-China trade relations, including tariff pauses and selective cuts, has alleviated market tensions and reduced immediate recession risks. Consequently, U.S. stocks have recovered most losses since late February, with the S&P 500 down only 1.0% year-to-date. Bitcoin, benefiting from these developments and progress in U.S. stablecoin legislation, has reached a new all-time high, up 17.8% year-to-date.

Despite the reduction in tariffs from peak levels, they remain elevated compared to pre-trade war norms. Concurrently, persistent Federal Reserve tightening and higher market yields present dual challenges: slowing growth amid stubborn inflation and expansive fiscal spending that may erode confidence in long-term fiscal sustainability. These factors have contributed to global fund flows moving away from the U.S. dollar, with the DXY index down 8.3% year-to-date, and a steeper Treasury yield curve—a trend likely to continue until policies shift towards enhanced fiscal control.

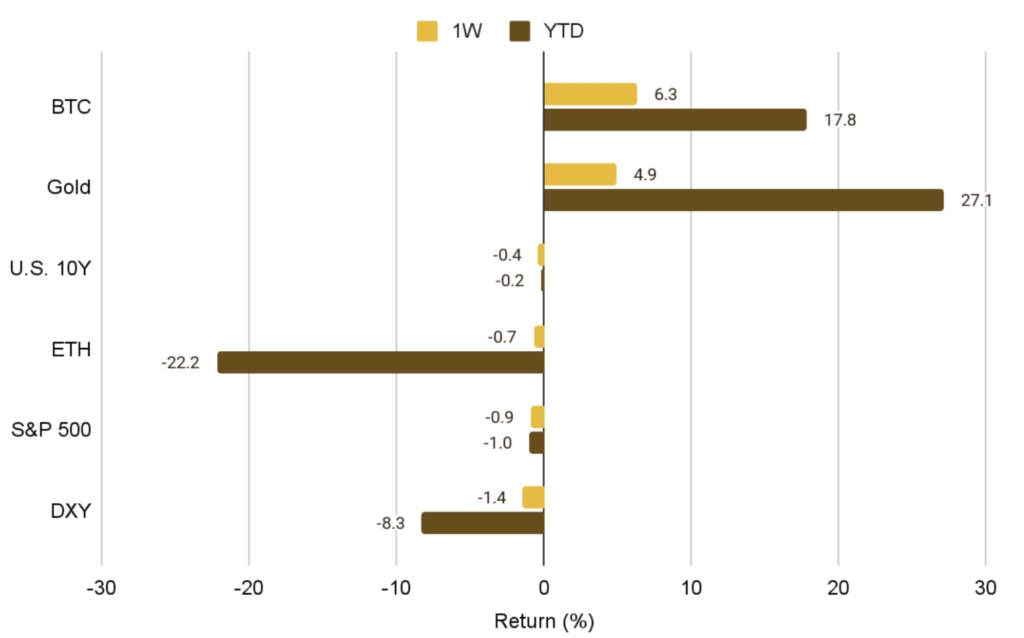

The latest market snapshot reveals contrasting performances across asset classes. According to the weekly returns data:

- Bitcoin (BTC) recorded a 1-week gain of 6.3%, pushing its year-to-date (YTD) return to 17.8%, indicating continued investor confidence.

- Ethereum (ETH), however, saw a significant weekly drop of 22.2%, bringing its YTD performance to -0.7%, reflecting market volatility possibly linked to shifting sentiment or Ethereum-specific developments.

- Gold gained 4.9% in the week, adding to its 27.1% YTD growth, maintaining its role as a safe-haven asset amid macroeconomic uncertainty.

- Meanwhile, traditional markets like the S&P 500 and the U.S. 10-Year Treasury posted minor declines, indicating investor caution.

- The U.S. Dollar Index (DXY) also fell by 1.4% for the week, with a broader YTD loss of 8.3%, reflecting weakening dollar strength globally.

Looking ahead, several macroeconomic and crypto events may shape the next week’s outlook. Key highlights include:

- May 22: U.S. S&P Global Flash Services PMI and 20-Year Bond Auction—critical indicators of U.S. economic strength.

- May 23: Japan’s CPI release will shed light on inflation trends influencing Bank of Japan policy.

- May 26: Fed Chair Powell’s speech could provide pivotal clues on future rate decisions.

- May 27: Crypto enthusiasts will closely watch the Bitcoin 2025 Conference and ETHPrague 2025, both potential sources of major announcements.

- May 29: U.S. FOMC Meeting Minutes and Japan’s unemployment data will offer further macroeconomic direction.

These data points and events are likely to drive volatility across both traditional and digital asset markets.

Digital Assets Performance

Bitcoin rose 6.3% over the past week, reaching a new all-time high of $110,797. Among the top five cryptocurrencies by market capitalization, only Bitcoin has surpassed its high from the beginning of the year.

Ethereum (ETH), while remaining largely flat this week, experienced a significant surge of 43% the previous week, climbing from approximately $1,820 to $2,600. This marked its largest 7-day gain since 2021, when decentralized finance (DeFi) first gained prominence.

U.S. spot Bitcoin exchange-traded products (ETPs) are on track for a sixth consecutive week of net inflows, pushing total inflows above $8 billion—the third-highest six-week total since their launch in early 2024. This momentum has driven cumulative net inflows to a new all-time high of $43.4 billion. In contrast, North American gold ETPs have recorded two consecutive weeks of outflows, indicating softer investor demand for the traditional safe-haven asset.

Regulatory Developments: The GENIUS Act

On May 19, 2025, the U.S. Senate advanced the GENIUS Act through a 66-32 cloture vote, paving the way for formal debate and amendments. While the bill is not yet final and requires further Senate and House approval, potential enactment could occur as early as July. The development has already sparked significant discussion across the crypto industry and is broadly viewed as a positive signal.

Key preliminary provisions of the GENIUS Act include:

- Definition of “Payment Stablecoin”: Excludes payment stablecoins from securities and commodities classification, potentially impacting DeFi tokens.

- U.S. Issuance and Oversight: Only U.S.-licensed entities may issue payment stablecoins domestically; the bill also proposes oversight mechanisms for foreign issuers operating within U.S. jurisdiction.

- Bank-Like Regulations: Issuers will be subject to bank-level regulation, with a three-year grace period for digital asset service providers.

- Reserve Requirements: Stablecoins must be backed by reserves in USD, Treasury bills, or similarly liquid assets.

- Prohibition on Issuer Yields: Licensed issuers cannot offer interest, reinforcing stablecoins as a medium of payment rather than an investment vehicle.

The proposed legislation introduces a clear regulatory framework for stablecoins, likely enhancing market stability, legitimizing the asset class, and attracting traditional financial institutions. As a global regulatory leader, the U.S. could also influence international standards and promote alignment across jurisdictions.

Market Movers

As of May 23, 2025, the global cryptocurrency market capitalization stands at $3.46 trillion, down by 1.04% over the last day. Bitcoin traded between $107,250 and $111,959 over the past 24 hours, currently priced at $111,149, up by 0.42%.

Most major cryptocurrencies by market capitalization are trading mixed. Market outperformers include WLD, FET, and KERNEL, up by 19%, 15%, and 13%, respectively.

Conclusion

The past week has been pivotal for the cryptocurrency market, with Bitcoin reaching new heights amid easing trade tensions and significant regulatory developments. The advancement of the GENIUS Act signals a move towards clearer regulatory frameworks, potentially fostering greater stability and institutional participation in the crypto space. As the market continues to evolve, investors and stakeholders will closely monitor these developments and their implications for the broader financial ecosystem.