- Binance users withdrew a total of $360 million on Friday, according to recent statistics.

- Binance Coin (BNB) has lost 29% of its value in the last two months.

Despite the recovery in the cryptocurrency markets following the demise of the FTX exchange, the situation with Binance withdrawals has not yet normalized. According to a recent report from Forbes, Binance has lost $12 billion in assets as a result of users continuing to withdraw money from the exchange.

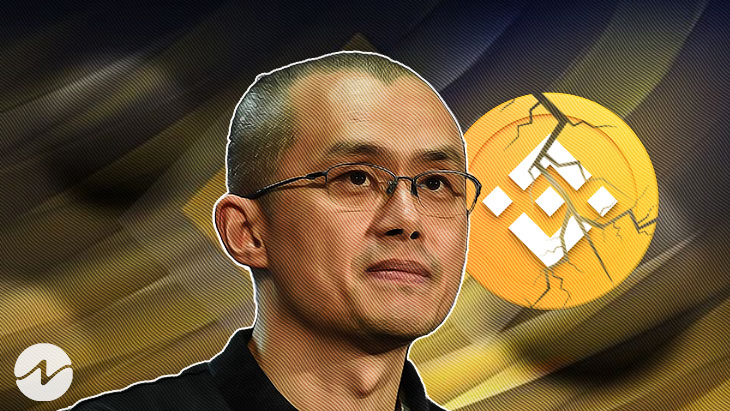

Binance, the leading crypto exchange, is currently having a hard time keeping its holdings. Investors have been selling their crypto since rival FTX collapsed, and despite claims from CEO Changpeng Zhao (CZ) that things had calmed, outflows are now accelerating.

Defillama, a crypto data company revealed that Binance customers withdrew a net of $360 million on Friday. Also, another crypto statistics company, Nansen, said in December that the platform had lost $3 billion in assets over the previous week, which was equal to 4% of the firm’s total assets at the time. According to a Forbes study, Binance lost 15% of its assets. However, in less than two months, approximately 25% of Binance’s holdings left the exchange.

Are Binance Tokens Declining?

The performance of Binance Coin (BNB) and Binance USD (BUSD), the native tokens of the exchange, is the best indicator of investors’ lack of confidence. As per Forbes, BNB has lost 29% of its value in the last two months, leaving 29 million of the tokens on Binance, 51% fewer than the exchange announced on November 10. In the meantime, the firm’s stock of BUSD stablecoins fell by 40%.

The trading platform has suffered from the nearly one-year fall in digital assets, even though it is still the largest cryptocurrency exchange by volume. According to Nomics, their BNB token is down over 37% from a year ago. Moreover, Forbes also estimates that the exchange lost around $3 billion annually as a result of ceasing to charge fees for spot Bitcoin (BTC) trading when the price sank.