- BNB breaks above descending trend line but faces potential short-lived rally.

- Technical indicators show weakening buying momentum and bearish divergence.

- Price targets: possible rise to $522.90 and $600, or drop to $468.90 if retest fails.

Binance Coin (BNB) finds itself at a critical juncture following its recent breakout above a descending trend line that had constrained its price action since August 23.

While this development initially sparked optimism among investors, mounting evidence suggests that the current rally may be short-lived, as buying momentum appears insufficient to sustain the upward trajectory.

The altcoin’s journey to this point has been marked by significant volatility. After reaching a peak of $600 on August 23, BNB faced intensified selling pressure, pushing its price below a descending trend line.

This bearish pattern, characterized by consistent rejection at a downward-sloping resistance level, persisted until the past weekend when a temporary easing of selling pressure allowed bulls to breach the trend line.

Technical indicators paint concerning picture for BNB

However, technical indicators paint a concerning picture for BNB’s near-term prospects. The Chaikin Money Flow (CMF), a key metric tracking capital flows, has dipped below the zero line, signaling a bearish divergence with the coin’s rising price.

This disconnect between price action and underlying buying pressure suggests that the current uptrend may be losing steam, potentially setting the stage for a correction or reversal.

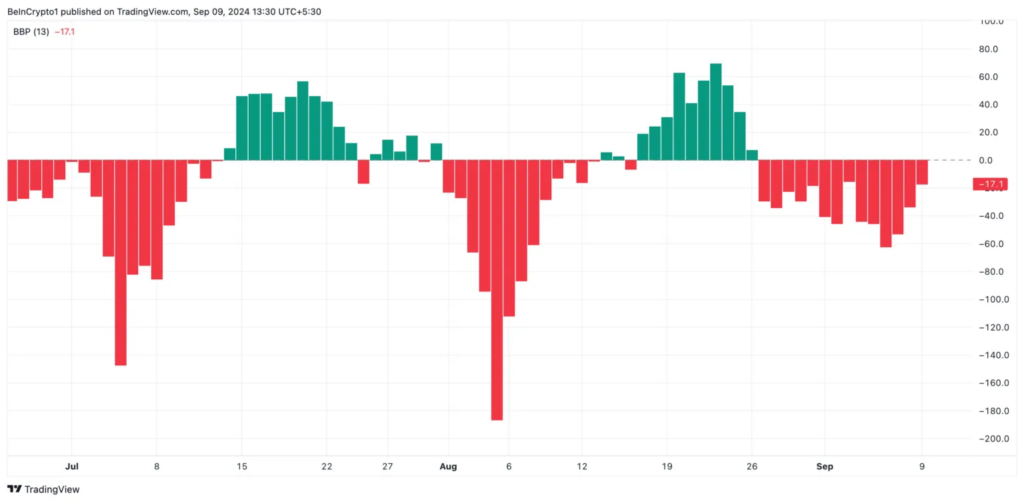

Further compounding BNB’s challenges is its negative Bull Bear Power reading, currently standing at -17.1. This indicator, which measures the balance between buyers and sellers, suggests that bearish forces currently dominate the market, potentially limiting the sustainability of the ongoing rally.

Despite these bearish signals, futures traders appear undeterred in their optimism towards BNB. The coin’s positive funding rate across exchanges, currently at 0.0005%, indicates that more traders are betting on price appreciation than decline.

This sentiment, if coupled with a shift in broader market dynamics, could potentially fuel a push towards the $522.90 level and, in a more optimistic scenario, a rally back to the $600 mark.