- Ethereum exchange reserves drop by 1 million ETH in past month.

- May 12 saw largest single-day whale accumulation in history.

- Golden cross technical pattern signals potential move toward $3,000.

Ethereum’s price has recovered over 50% in May, with on-chain data revealing fundamental shifts in investor behavior following the Pectra upgrade. Exchange withdrawals, diminishing reserves, and record whale accumulation have all reached key milestones, prompting analysts to project higher price levels in the coming weeks.

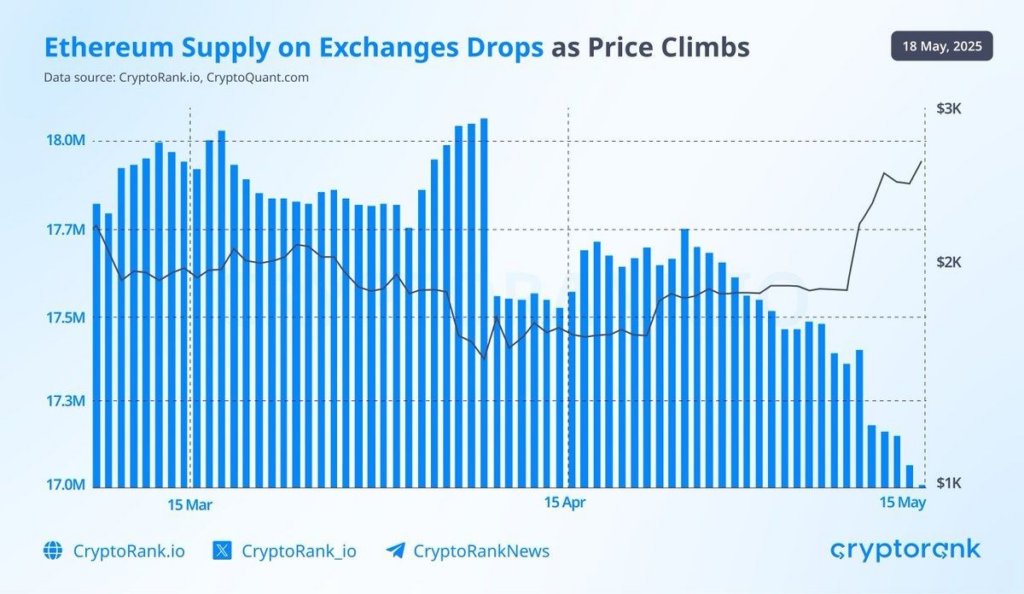

Cryptorank data shows that Ethereum available on CEXs has dropped from over 18 million to around 17 million in a single month. This reduction of more than 1 million ETH represents a 5.5% decrease in total exchange-held supply.

“Over the past month, more than 1 million ETH have been withdrawn from centralized exchanges, which accounts for approximately 5.5% of the total ETH held on these platforms. This trend suggests that users are increasingly choosing to accumulate Ethereum rather than trade it,” Cryptorank reported.

Binance leads Ethereum exchange outflows

CryptoQuant data shows Binance alone saw withdrawals exceeding 300,000 ETH in the past month. Since January, users have removed more than 800,000 ETH from the platform.

This withdrawal activity occurred both during ETH’s price decline below $1,400 in early April and accelerated as prices rebounded above $2,400 in May. The inverse correlation between falling exchange reserves and rising prices reinforces the supply-demand dynamic currently favoring bulls.

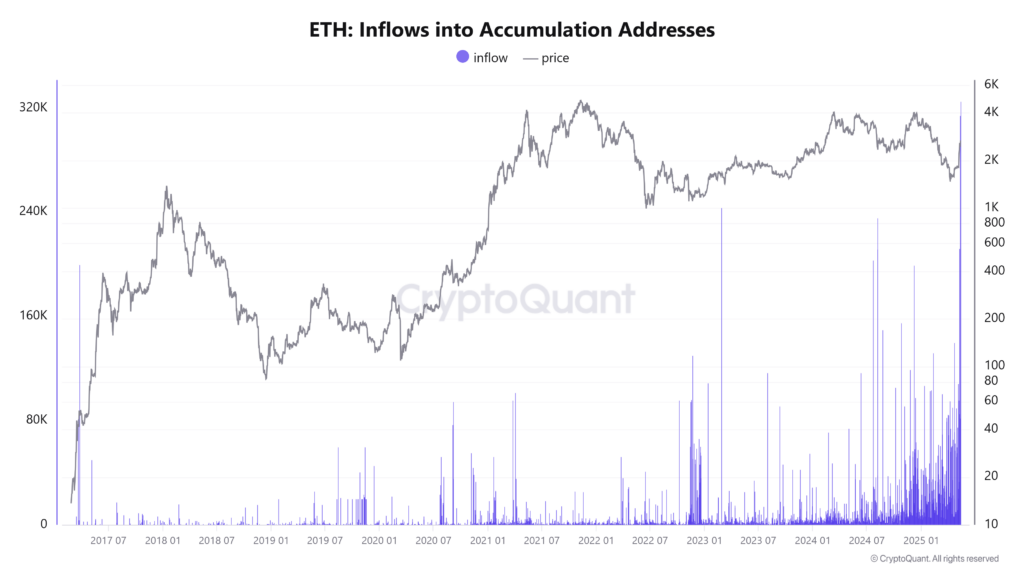

According to CryptoQuant, on May 12, whale wallets absorbed approximately 325,000 ETH in a single day, the most one-day accumulation ever recorded, marking the largest intake ever recorded by massive accumulation addresses.

When whales accumulate at this scale, they typically withdraw ETH from exchanges to secure storage in cold wallets. This process reduces circulating supply and often creates upward price pressure as market liquidity tightens.

These large holders appear to be positioning for longer-term price appreciation rather than preparing for immediate sales, suggesting confidence in Ethereum’s fundamentals following the Pectra upgrade.