- XRP recovers from 8% drop, holding $0.50 support level.

- Weighted Sentiment turns positive, suggesting market optimism.

- Price targets: potential rise to $0.60 if momentum sustains above 50 EMA.

Ripple (XRP) finds itself at a critical juncture following an 8% decline between October 21-25.

While historical patterns suggest such rebounds often prove temporary, current market indicators hint at the possibility of a more sustainable recovery phase as bulls vigorously defend the crucial $0.50 support level.

Santiment’s on-chain analysis reveals a significant shift in XRP’s Weighted Sentiment, which has emerged from negative territory into positive readings.

This transition typically signals growing market optimism, potentially catalyzing increased demand and subsequent price appreciation. However, market participants should note that sentiment alone may not suffice to drive sustained price growth without corresponding buying pressure.

4-hour chart presents encouraging signs of XRP

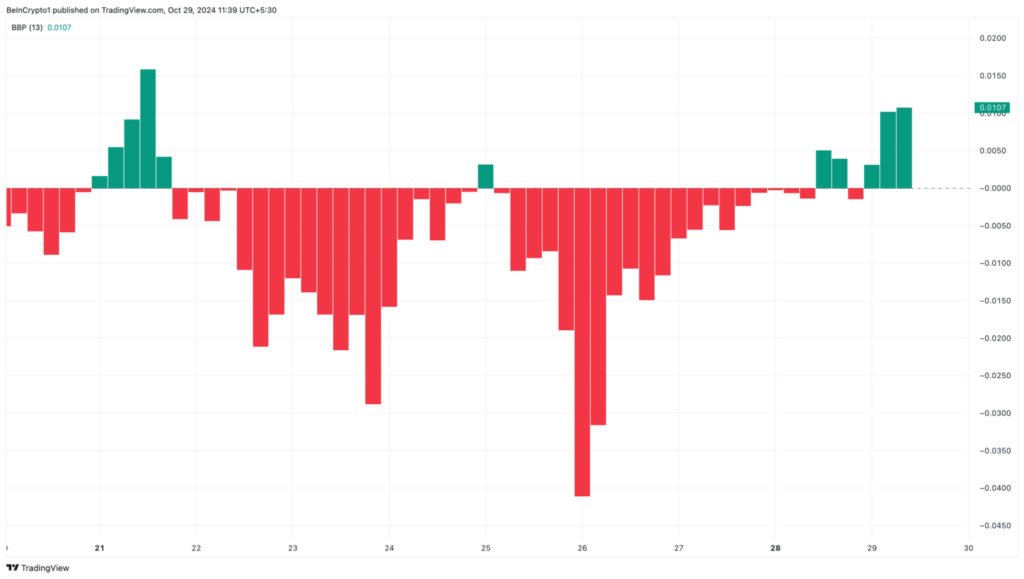

The 4-hour chart presents encouraging signs for XRP bulls through the Bull Bear Power (BBP) indicator, which measures the balance between buying and selling forces.

Current readings suggest buyers maintain control of market momentum, though continued positive BBP values will be crucial for sustaining the upward trajectory and breaking through immediate resistance levels.

Technical analysis of the daily timeframe adds complexity to XRP’s current position.

While the cryptocurrency initially showed weakness by falling below the 20-day Exponential Moving Average (EMA) on October 21, bulls have demonstrated resilience by reclaiming the $0.50 support level. This recovery opens the possibility for testing higher resistance zones.

Looking ahead, XRP’s price action appears poised to challenge the 50 EMA. A successful breach of this technical barrier could pave the way for advances toward $0.55.