- Ripple’s XRP token price has maintained an uptrend in the past 12 hours as anticipation builds for a closed-door meeting between Ripple and the SEC.

- XRP’s Relative Strength Index (RSI) and derivatives market activity suggest increased buying pressure and demand for long positions.

- The widening gap in XRP’s Bollinger Bands (BB) indicator confirms heightened price volatility.

The price of Ripple’s XRP token has been on an upward trajectory over the past 12 hours, as the cryptocurrency community eagerly awaits the outcome of a closed-door meeting between the payment services provider and the Securities and Exchange Commission (SEC).

This meeting, which was rescheduled from an earlier date, is expected to focus on resolving the ongoing legal battle between the two entities.

Ripple Experiences Increased Buying Activity

XRP is currently trading at $0.60, with the token’s price surging and trending within an ascending channel in anticipation of Ripple’s upcoming meeting with regulators.

An analysis of the altcoin’s price movements on a 12-hour chart reveals a notable uptick in demand.

The Relative Strength Index (RSI), a technical indicator that measures overbought and oversold market conditions, currently stands at 59.02, well above its 50-neutral line. This suggests that buying pressure is outweighing selling activity among market participants.

In addition to the growth observed in XRP’s spot market, the token’s derivatives market has also witnessed a significant surge in activity.

Over the past 24 hours, trading volume in XRP derivatives has reached an impressive $3.82 billion, representing a substantial 65% increase.

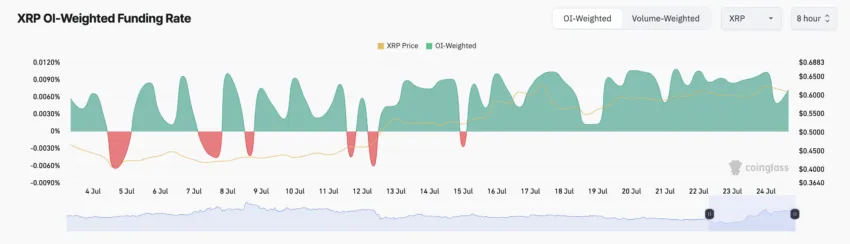

Moreover, XRP’s funding rate across various cryptocurrency exchanges has remained in positive territory. At press time, the token’s funding rate stands at 0.0072%.

A positive funding rate indicates a heightened demand for long positions, suggesting that a greater number of traders anticipate an uptick in the asset’s price compared to those buying it with the intention of selling at a lower price.