- XRP surged 13% in 24 hours as the broader crypto market rebounded from recent lows.

- Declining trading volume (-22%) and a negative Balance of Power (-0.57) suggest weak demand.

- If buying momentum fades, XRP could drop to $2.13 or even $1.48; renewed demand could push it to $2.94.

XRP has bounced back 13% in the past 24 hours, rallying alongside the broader cryptocurrency market after a period of decline. The recent downturn was triggered by concerns over Donald Trump’s proposed tariffs on Canada, Mexico, and China. However, with Trump agreeing to delay tariffs on Canada and Mexico for 30 days, market sentiment improved, leading to renewed buying activity.

XRP Rally Faces Weak Demand Signals

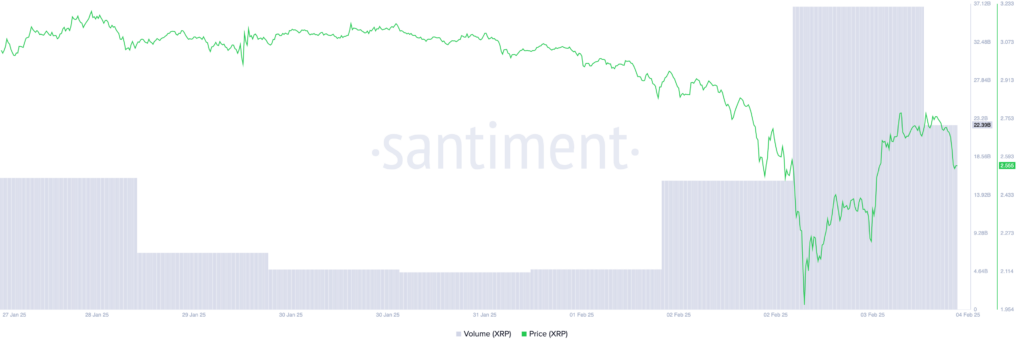

Despite this double-digit price surge, on-chain indicators suggest the rally may not last. A major red flag is XRP’s declining trading volume, which has dropped 22% to $22.39 billion over the past 24 hours.

In general, rising prices paired with falling volume indicate weak buying momentum, as fewer traders are actively supporting the uptrend. This suggests that XRP’s recovery lacks strong demand, increasing the likelihood of a price reversal.

Additionally, XRP’s Balance of Power (BoP) indicator remains negative at -0.57, signaling that bearish pressure still dominates the market. The BoP tracks the strength of buyers versus sellers, and when negative, it suggests that sellers still control price action, despite the recent gains.

At press time, XRP marks a 45% recovery from Monday’s low of $1.77. However, the sustainability of this rally depends on whether demand increases or weakens in the coming days.

- Bearish Scenario: If trading volume continues to decline and market momentum fades, XRP could retrace to $2.13. A break below this support could send the price below $2, potentially dropping to $1.48, a level last seen in November.

- Bullish Scenario: If demand resurges, XRP could climb toward $2.94, invalidating the bearish outlook and signaling further upside.