- SEC and Ripple set for another closed-door meeting, sparking settlement speculation.

- XRP’s price and trading volume show bearish trends ahead of the meeting.

- Market analysts provide mixed predictions based on potential meeting outcomes.

As the cryptocurrency world holds its breath, Ripple and the Securities and Exchange Commission (SEC) prepare for another closed-door encounter.

This imminent meeting has ignited a flurry of speculation about a potential settlement in their long-standing legal battle. Despite the anticipation, the market’s reaction paints a picture of cautious pessimism, with XRP experiencing downward pressure on both price and trading activity.

Decoding the XRP Market’s Bearish Signals

In the hours leading up to this pivotal discussion, XRP’s market performance has been less than stellar. The digital asset currently changes hands at $0.60, marking a 6% decline over the past day.

More tellingly, the trading volume has plummeted by 27%, totaling a mere $27 million. These figures suggest a retreat by traders, potentially bracing for volatility or expressing skepticism about immediate positive outcomes.

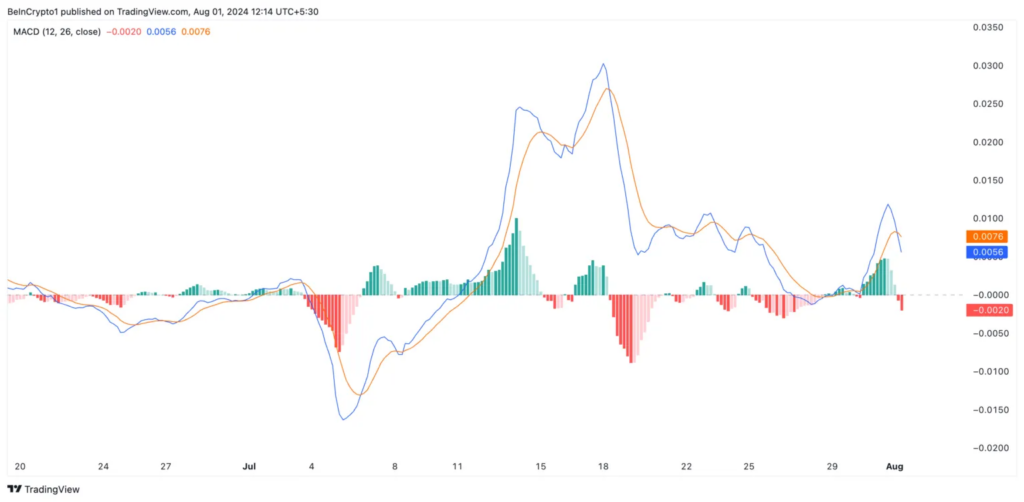

A deep dive into XRP’s technical analysis reveals a growing bearish sentiment. The Moving Average Convergence/Divergence (MACD) indicator, a trusted tool for gauging market momentum, shows the MACD line dipping below its signal counterpart.

This crossover typically signals a shift towards selling pressure, indicating that bears currently have the upper hand in the market.

Further compounding the bearish outlook, XRP’s Relative Strength Index (RSI) sits at a precarious 46.08, trending downwards and failing to breach the crucial 50-neutral threshold.

This reading suggests that sellers are becoming increasingly dominant, with the potential for continued downward price action in the short term.

The derivatives sector for XRP tells a similar tale of caution. Over the last 24 hours, derivatives trading volume has nosedived by 18%, while open interest has contracted by 10%.

This reduction in open positions without corresponding new entries typically indicates a lack of confidence in future price appreciation, further reinforcing the bearish narrative.