- Gemini filed for an IPO listing despite $282.5 million losses in H1 2025.

- Cash reserves plummeted from $341.5 million to $161.9 million, highlighting urgent capital needs.

The Winklevoss twins’ cryptocurrency exchange Gemini has submitted an official listing application on Nasdaq, with the ticker GEMI. The move is a strategic entry into the public markets as the crypto industry is optimistic again. The company is also looking to take advantage of a positive regulatory environment under the Trump administration despite recent operational issues.

Growing Losses Shadow Public Market Ambitions

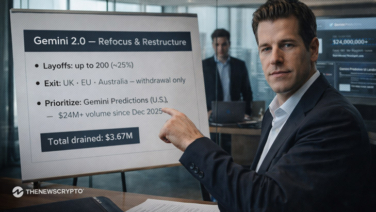

Gemini Space Station recently filed SEC documents showing significant financial headwinds prior to its expected initial public offering. The crypto exchange had $142.2 million in revenue in 2024 but incurred massive net losses of $158.5 million. When providing financial guidance to the market, things further deteriorated in early 2025 with material losses increasing to $282.5 million against $67.9 million in revenue.

Gemini’s cash position reflects the inherent operational pressures caused by continuous losses incurred over the past several years and from rising business costs. Cash reserves at the close of 2024 were material at $341.5 million, but are now vulnerable, having fallen to $161.9 million in the first half of 2025. The deterioration in cash reserves indicates the urgency to raise money in the public capital markets and alleviate financial pressures to continue operating as regulated crypto-exchange services and provide custodial services.

Gemini was started in 2014 by Cameron and Tyler Winklevoss and operates regulated crypto exchange services and custodial services. Retail customers use the platform for blockchain products such as the GUSD stablecoin and credit cards with crypto rewards.

Goldman Sachs, Morgan Stanley, and Citigroup will be the lead underwriters for the public debut of Gemini. The IPO price range has yet to be announced, though this could come shortly now that conditions appear good for crypto companies.

After listing, Gemini will utilize a dual-class share structure, allowing founders to maintain control through superior voting power; the Winklevoss brothers will continue to hold Class B shares with ten votes each, while public investors will receive single-vote Class A shares.

This supports the timing with the wider crypto momentum following Trump’s pro-digital asset policy and regulatory clarity. The successful recent IPOs of Circle Internet Group, which raised $1.1 billion in June (with shares closing the debut day 167% higher than issue price of $31), and Bullish, which debuted for a 83.8% gain, closing day one at $68 and reaching $118 at peek intraday trading, encourage strong investor appetite for crypto businesses.

Gemini’s public market entry represents one more test of institutional investor confidence in cryptocurrency infrastructure businesses.

Highlighted Crypto News Today:

Mantle Witnesses Massive Bullish Momentum With 26% Upside Potential