- The German government has slashed its Bitcoin holdings by 90%, from 49,860 BTC to 6,146 BTC.

- Despite reaching an all-time high of $73,750 earlier, Bitcoin has recently struggled to surpass the $60,000 zone.

The German government’s Bitcoin holdings have seen a drastic 90% reduction, with Bitcoin (BTC) falling to break the $60,000 zone twice in 48 hours. This substantial sell-off has led to heightened market volatility and investor concern.

In January, the German authorities seized a substantial stash of Bitcoin, totaling 49,860 BTC, following a crackdown on a film pirating website. Initially intended as a strategic reserve, these BTC holdings have now dwindled to 6,146 BTC, following a series of transactions on various crypto exchanges.

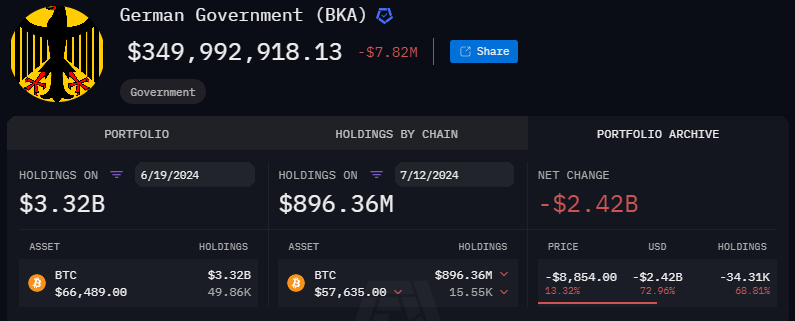

Since the German government began selling its Bitcoin on June 19, it has offloaded over 34,410 BTC valued at approximately $2.42 billion to exchanges like Coinbase, Bitstamp, and Kraken, as well as to several anonymous addresses. This transaction marked a sharp 90% drop from the initial 49,857 BTC holding to just 6,146 BTC.

According to Arkham, currently, the government Bitcoin wallet holds only 6,146 BTC, valued at around $350 million at the current price of $57,211.

Analyzing Bitcoin’s Current Performance

Historically, such large-scale sell-offs by government entities can lead to increased market activity and potential price fluctuations. However, the German government’s strategic distribution of BTC across different platforms may help mitigate sudden and extreme price swings.

Still, this massive sell-off has also triggered significant market sentiment shifts. Bitcoin has entered the extreme fear zone for the first time in 18 months, with the Fear and Greed Index dropping to 25. This is concerning, as BTC had already been in the fear zone for days, previously at 29 on the index.

However, as Germany’s Bitcoin liquidation nears its end, market analysts predict the selling spree could conclude by Friday or early next week.

Bitcoin’s performance this month has been notably volatile. The cryptocurrency reached an all-time high of $73,750 on March 14, sparking predictions of surpassing the $100,000 zone, especially with the BTC halving event in April.

Despite these bullish predictions, BTC has struggled to break the $60,000 mark, causing heightened fear. Even the BTC price dropped to $53,904 but managed to recover to $59,323, only to falter again. At the time of writing, Bitcoin trades at $57,135, having declined over 16% in the past 30 days.

As the German government’s Bitcoin holdings near depletion, market sentiment might improve, potentially lifting Bitcoin prices. If positive momentum continues, BTC could climb to the 23.6% Fibonacci retracement level, from a low of $57,100 to a high of $59,683, with bullish activity above the $58,211 level.

However, Bitcoin remains below the simple moving average (SMA) for the 4-hour BTC/USDT pair. If it fails to hold above the $56,500 level, BTC could see a decline to the 78.6% Fibonacci retracement level of $54,795.