- Bitcoin nears 2025 low amid crypto market selloff and volatility.

- U.S.-China trade tensions and Trump’s policies heighten economic uncertainty.

- Upcoming CPI and PPI reports could impact Bitcoin’s price direction.

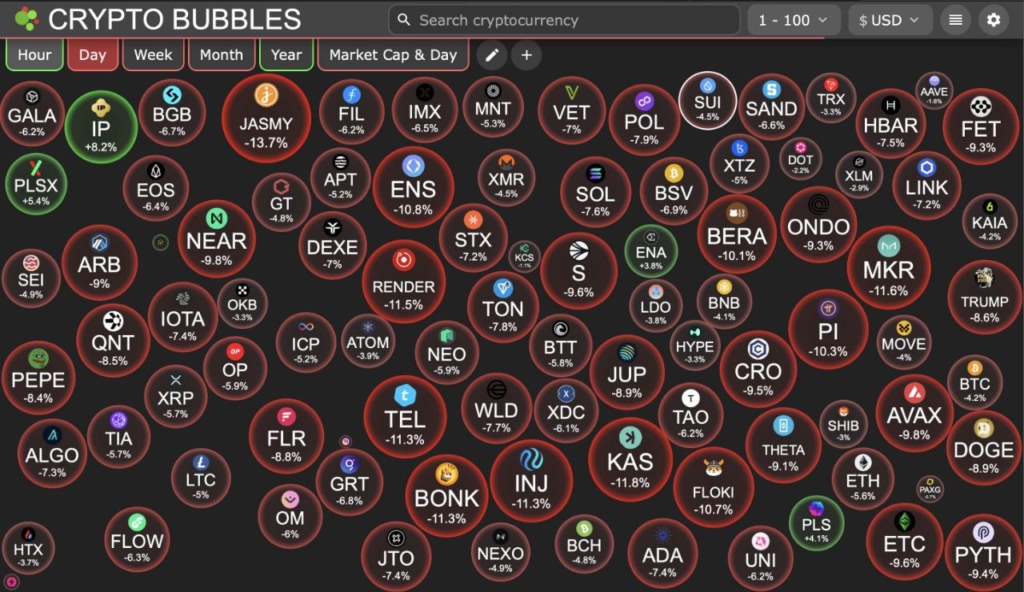

The Bitcoin-led crypto market was subject to a shock sell-off, with Bitcoin approaching its 2025 low of $78,000.

Bitcoin has shed more than 11% of its value in the last week, erasing most of its recent gains and trading at $82,176, lower by more than 4% in the last 24 hours.

The across-the-board decline saw altcoins such as Solana (SOL), Ethereum (ETH), Cardano (ADA), and Dogecoin (DOGE) losing heavily as well, with liquidations totaling more than $600 million.

The Role of Economic

The sell-off in crypto comes as economic uncertainty grows. US-China trade tensions and President Trump’s economic policy already caused instability in markets. The recent statements by Trump regarding the chances of dislocation in the near term because of tariffs and budget cuts fueled additional concerns.

Trump admitted that the policies, which are painful short term, are part of a broader plan to get America richer. Trump’s economic policies have drawn comparisons to policies of the earlier Federal Reserve Chair Paul Volcker in the 1980s, whose policy, while instituted hardship in the short run, eventually steadied the economy.

The repeated trade war between China and America, where new tariffs on US agricultural goods from China, have also created uncertainty in the markets. Federal Reserve Chairman Jerome Powell’s recent circumspection towards interest rates following weak US job numbers has kept traders on guard about the prospect of the economy.

What’s for Bitcoin?

Bitcoin’s fall has inspired mixed responses among investors. While others view the fall as a chance to purchase at a reduced price, others believe that more falls are forthcoming, particularly in the face of current economic uncertainty.

Traders are keeping a close eye on major economic releases, including the U.S. Consumer Price Index (CPI) and the Producer Price Index (PPI), both scheduled this week. These reports can be meaningful in determining the future price action of Bitcoin, with inflation readings tending to influence market mood.

As the market weather’s this volatility, the future outlook for Bitcoin will be influenced by a range of factors, including inflation trends, Federal Reserve policy, and overall economic conditions.