- The Fed is expected to announce a 0.25% rate cut on December 18, shaping market sentiment as it marks the third reduction since September.

- Investors will closely monitor updated forecasts on interest rates, GDP, and inflation for indications of future monetary policy direction.

- Any deviations in the Fed’s guidance could drive volatility across equities, bonds, commodities, and the U.S. dollar.

The U.S. Federal Reserve is set to deliver its final monetary policy decision of the year on December 18. A 0.25% interest rate cut is widely expected, marking the third rate reduction since September.

However, beyond this anticipated move, uncertainty looms over the Fed’s forward guidance and the pace of future cuts, making this decision a potential market-shifting event.

What to Expect From the Fed Meeting

The Fed will announce its policy decision at 2 p.m. ET, accompanied by updated Federal Open Market Committee (FOMC) projections. This will be followed by a press conference with Fed Chair Jerome Powell at 2:30 p.m. ET. These projections will provide critical insights into the Fed’s outlook on interest rates, GDP growth, inflation, and unemployment for the years ahead.

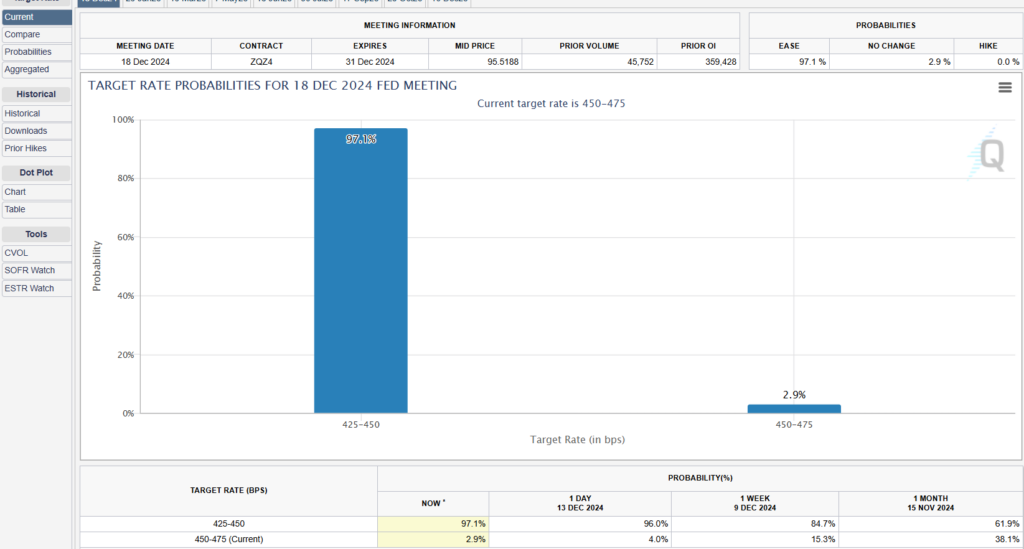

According to the CME FedWatch Tool, as of December 15, there is a 96% probability of a 0.25% rate cut, leaving just a 4% chance for no change. Investors are keenly watching whether the FOMC will adjust its dot plot, which illustrates individual members’ forecasts for interest rates.

In September, the dot plot projected the federal funds rate to be 3.4%. That is by the end of 2025 and 2.9% by the end of 2026. Any significant shift in these projections could significantly impact markets.

Key Economic Data Supporting the Decision

This week is packed with crucial economic data releases, including November’s retail sales, industrial production, and personal income and spending reports. These metrics will help shape the Fed’s decision and provide a snapshot of the economy’s health heading into 2024.

Additionally, the FOMC’s projections are expected to shed light on inflation trends and the trajectory of interest rate cuts. While some analysts predict a steady course with minimal changes to September’s projections. Others caution that fewer or slower rate cuts could surprise the market.

Market Reactions and Implications

The Fed’s decision and updated projections will likely trigger movements across multiple asset classes. If projections remain unchanged, equity prices, bond prices, and commodities. Like crude oil and industrial metals could see supportive gains. Conversely, a scenario with slower or fewer rate cuts could strengthen the dollar and bond yields while pressuring equities and commodities.

With the December Fed meeting being one of the last major economic events of the year, market participants will scrutinize Chair Powell’s statements. And the FOMC’s updated forecasts for clues about the policy direction in 2024. As holiday trading volumes decline, any surprises from the Fed could amplify market volatility.

Stay tuned for the Fed’s announcement, as it could set the economic policy and market trends heading into the new year.