- Cardano whale addresses add 240 million ADA worth over $175 million in past week.

- Mean Coin Age metric shows long-term holders refusing to sell despite market pressure.

- Price needs to break $0.77 resistance to confirm recovery toward $0.85 target.

Cardano (ADA) has struggled to generate significant bullish momentum in recent weeks, preventing the cryptocurrency from staging a comprehensive recovery amid broader market uncertainty.

Despite these challenges, the eighth-largest cryptocurrency by market capitalization has maintained a micro uptrend, bolstered by persistent support from a cohort of determined investors who continue to hold their positions, potentially setting the stage for a move toward higher price levels.

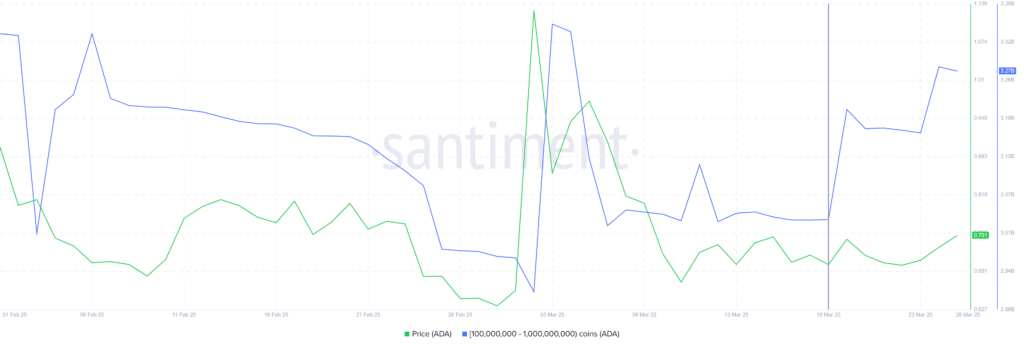

On-chain data reveals that whale addresses have been actively accumulating ADA tokens at current price levels, signaling strong confidence in the asset’s recovery potential. Over the past week, wallets holding between 100 million and 1 billion ADA have collectively added more than 240 million tokens to their holdings, representing an investment exceeding $175 million at current prices.

Strong Cardano accumulation shows conviction

This substantial accumulation by large investors demonstrates conviction in Cardano’s long-term value proposition and suggests these market participants anticipate price appreciation in the coming weeks. The strategic positioning by whales could provide essential buying pressure to help Cardano overcome key resistance levels that have capped its recent price action.

Santiment data shows that in addition to whale accumulation, Cardano’s macro momentum indicators are displaying promising signals despite the generally bearish market environment. The Mean Coin Age metric, which tracks the average age of tokens in circulation, has been steadily increasing over recent weeks. This upward trend indicates that long-term holders are refusing to liquidate their positions and are instead maintaining or extending their holding periods.

The rising Mean Coin Age reflects growing confidence among established Cardano investors regarding the cryptocurrency’s recovery prospects. This behavioral pattern from long-term holders provides crucial support for ADA’s price floor and could help prevent significant downside volatility during continued market uncertainty.

Technical analysis suggests that with continued support from both whales and long-term holders, Cardano could eventually break through the $0.77 resistance zone and target the $0.85 level. This price point represents a key milestone for establishing a confirmed recovery rally, and successfully breaching it could potentially lead to accelerated gains as sidelined investors return to the market.

Conversely, if Cardano fails to overcome the $0.77 barrier in the near term, the cryptocurrency will likely continue consolidating above its $0.70 support level. This scenario would leave ADA vulnerable to potential retests of lower support at $0.62, extending the consolidation phase and delaying meaningful recovery.